Best Practices for Financial Scenario Planning & Analysis

What is Financial Multi-Scenario Planning?

With multi-scenario Planning, companies are able to analyze several potential business outcomes and forecast what overall performance would look like with each of these models. What would happen to sales? Employee headcount? Cash flow? The key drivers of each scenario are identified and modeled out to create a complete picture of the budget or forecast. This allows companies to better prepare for and predict future performance, and help account for areas of uncertainty.Why is Financial Multi-Scenario Modeling Important?

When companies create an annual budget, it captures the best assumptions for performance in the coming year. These assumptions are largely influenced by historical data and trends, company strategy, and the individual budget contributor’s industry expertise and insight into the current market and economy. The more accurate budget contributors are with their assumptions, the more accurate the budget will be when compared against actual performance. Keep in mind, that a detailed annual budget only represents one potential outcome of the many variables that could present themselves in the coming year. While the final version of the budget may be considered the “most likely” outcome based on organizational expertise, it is only one possible scenario. As the economy, market, and internal operations of the business change, that “most likely” scenario may no longer align with current expectations. In fact, there may be one, two, three or more high probability scenarios that should be considered by executives and finance teams.Strategy and Scenarios: Align and Refine

Top-performing companies have budgets and forecasts that align tightly with company strategy. By planning for different financial scenarios, businesses can proactively prepare themselves for these potential outcomes, ensuring alignment to strategic goals and providing the ability to quickly adjust to changes where needed. Companies looking to implement multi scenario planning should focus on several key areas:- Identifying and capturing company strategy

- Defining the most probable scenarios

- Internal factors

- External factors

- Using driver-based models to define scenarios

- Measuring performance and refining models

Identify and Capture your Company Strategy

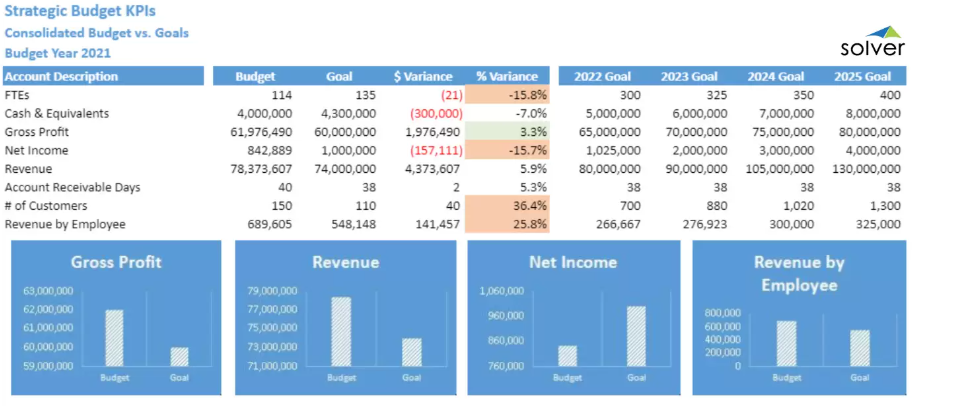

A well-defined financial and strategic plan acts as a compass to guide the company’s activities. But, a critical component to having an effective strategy, is ensuring it is not just known and understood by a few at the executive level, but that it is well socialized throughout the organization and it is being used to manage and measure performance. A solid strategic framework allows the company to set specific strategic goals that can be monitored and measured through key performance indicators (KPIs) . These KPIs provide an easy way to define success and measure and share results and goals within the organization. For example, if part of the company strategy is focused on increasing customer satisfaction, then some potential KPIs and goals might be:- Decrease average product shipping time from 8 hours to 2 hours by 6/30/2022

- Increase customer referrals by 15% by 12/31/2021

How to Define Probable Financial Scenarios

While the number of potential business outcomes in any given period is essentially infinite, only a small number of these would likely be considered “high probability”. These highly probable scenarios should be the focus of multi scenario planning. The goal is not to model out every potential scenario, but instead to focus on the meaningful ones that are most likely to occur.How to Build Financial Scenario Internal Factors

The majority of internal factors for scenario building link directly back to the overarching company strategy. At this point, the question of “how will these strategic goals be achieved” is transformed into potential scenarios. This is especially important when there is uncertainty or external factors that could impact which direction the company takes to achieve their goals. In the previous example, part of the sample company’s strategy focuses on increasing customer satisfaction. To achieve this goal there are numerous initiatives that could be undertaken such as:- Increasing headcount to improve shipping and customer service turnaround time

- Consolidating operations to a centralized warehouse

- Opening regional distribution centers

How to Build External Financial Scenario Planning Factors

Regardless of how well a business prepares, there are external factors that can derail those plans or cause a change of course. These vary by business and industry, but some general ones may include:- Economic downturn or recession

- Market changes

- Legislative changes

- Competitor shift or consolidation

Using Driver-Based Models to Define Scenarios

Recreating a time consuming annual budget process to build out additional high-probability financial forecast models is not a viable option. The creation of each model should be something that can be done very quickly, and that can be updated easily. The most effective way to do this is with a driver-based forecasting model that leverages a top down approach to generate a baseline from historical data and trends. This initial baseline becomes a starting point that can then be adjusted at a more detailed level for key areas such as revenue forecasting, workforce planning, operating expenses, and cash flow. Using easily adjustable drivers and assumptions allows for the modeling of unlimited outcomes and in-depth analysis of what-if scenarios.Measure Performance and Refine Models

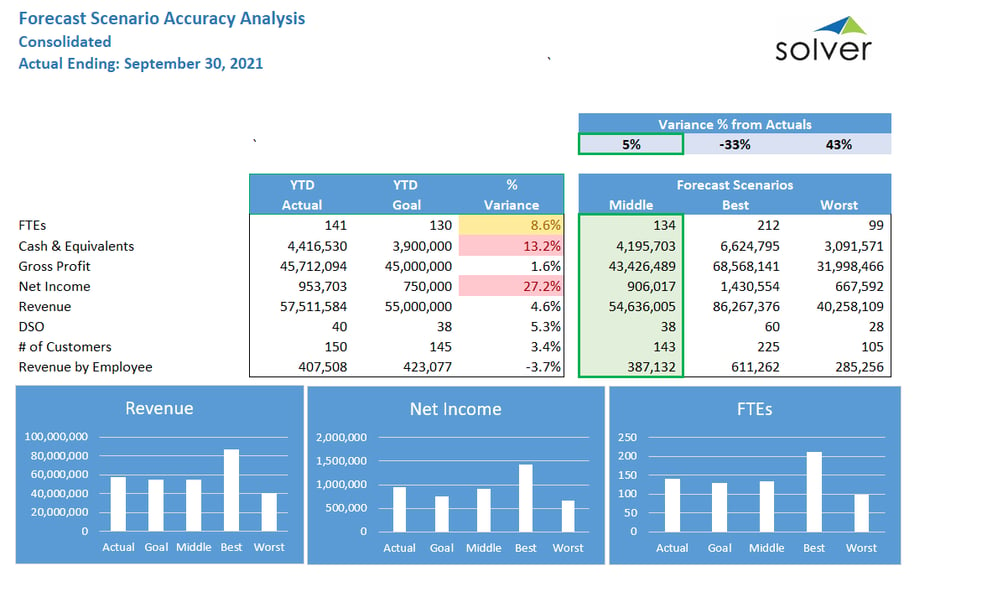

After developing a financial scenario model out of the highest probability scenarios, it’s critical that they aren’t put on the shelf to gather dust, but instead are analyzed on an ongoing basis for accuracy and to ensure the company is reaching its goals. Simple reports can be leveraged to determine which version of the forecast is proving to be most accurate, and this forecast version can then be slotted into existing reports and reporting packages to provide timely updated projections. Analysis will also identify areas of your model that require adjustment. This may point to an error in assumptions, methodology, or a change in market conditions. By isolating and identifying these variances, not only is a more accurate

financial mode

l created, but a better forecasting process is continuously developed.

Analysis will also identify areas of your model that require adjustment. This may point to an error in assumptions, methodology, or a change in market conditions. By isolating and identifying these variances, not only is a more accurate

financial mode

l created, but a better forecasting process is continuously developed.

Getting Your Financial Scenario Analysis Started with Solver

Solver’s cloud-based corporate performance management (CPM) solution provides the necessary tools to streamline and automate the multi scenario planning process . For additional information, contact Solver , or request a demo to see the solution in action.TAGS: Forecasting, Budgeting, CPM, Thought Leadership

Global Headquarters

Solver, Inc.

Phone: +1 (310) 691-5300