This article will explore today’s premier financial reporting and consolidation tools, with a focus on the most important features and functionalities, that Sage Intacct customers should consider when overseeing parent company financials.

There is a substantial population of Sage Intacct users who are managing the financial consolidations process for a parent corporation with more than one subsidiary. Aggregating corporate data from multiple entities, at times with disparate currency types, can be challenging without a modern financial consolidations tool. Data steadily increases in amount – and importance when it comes to decision-making. More and more executives are looking for the best tool that can empower business end users to consolidate information into one set of financial reports. This article is for the Sage Intacct customer who is involved with financial consolidations for a parent company, with a focus on your software options to achieve a combination of modern, powerful, and easy-to-use.

Financial Consolidations for Sage Intacct

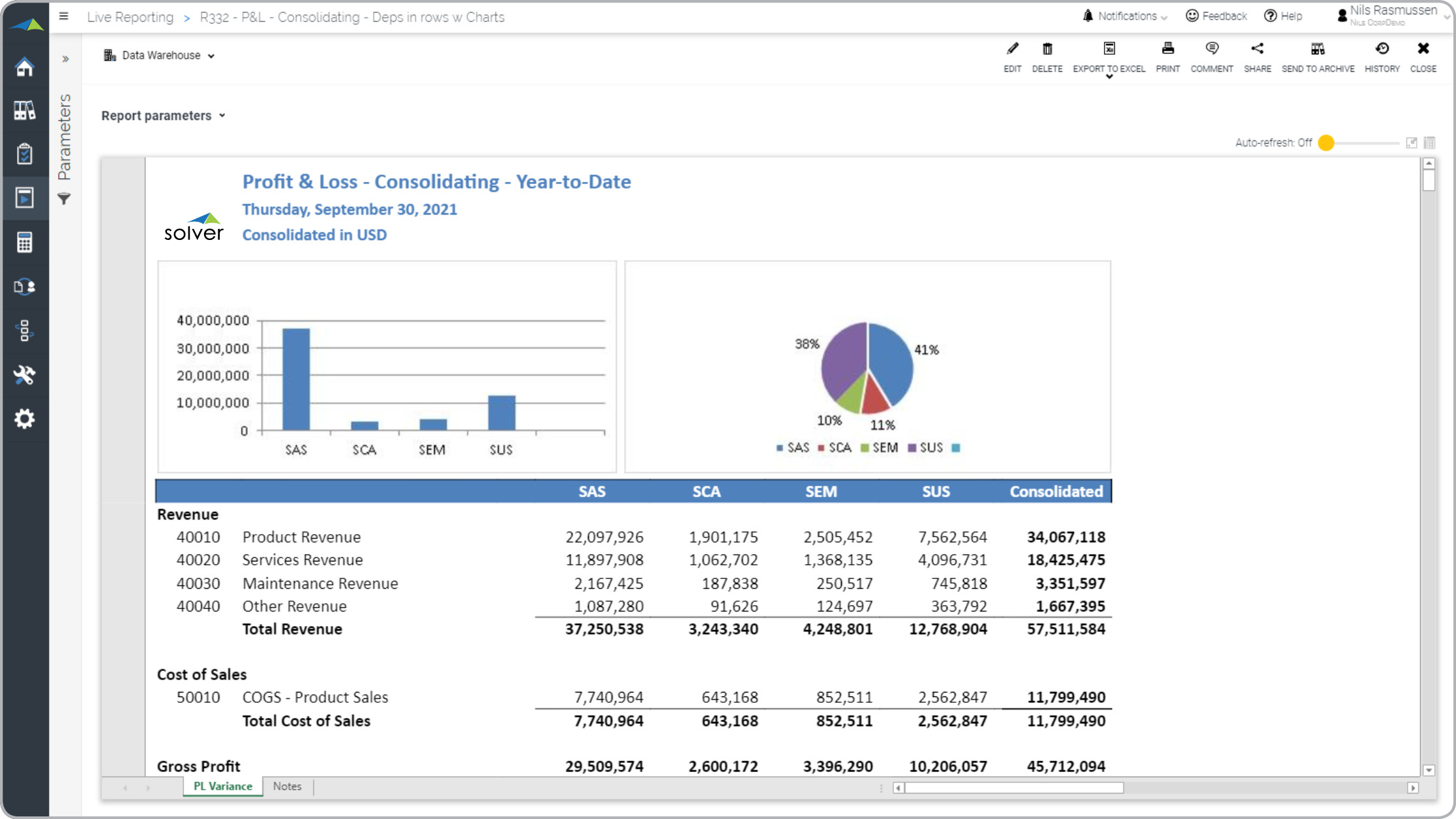

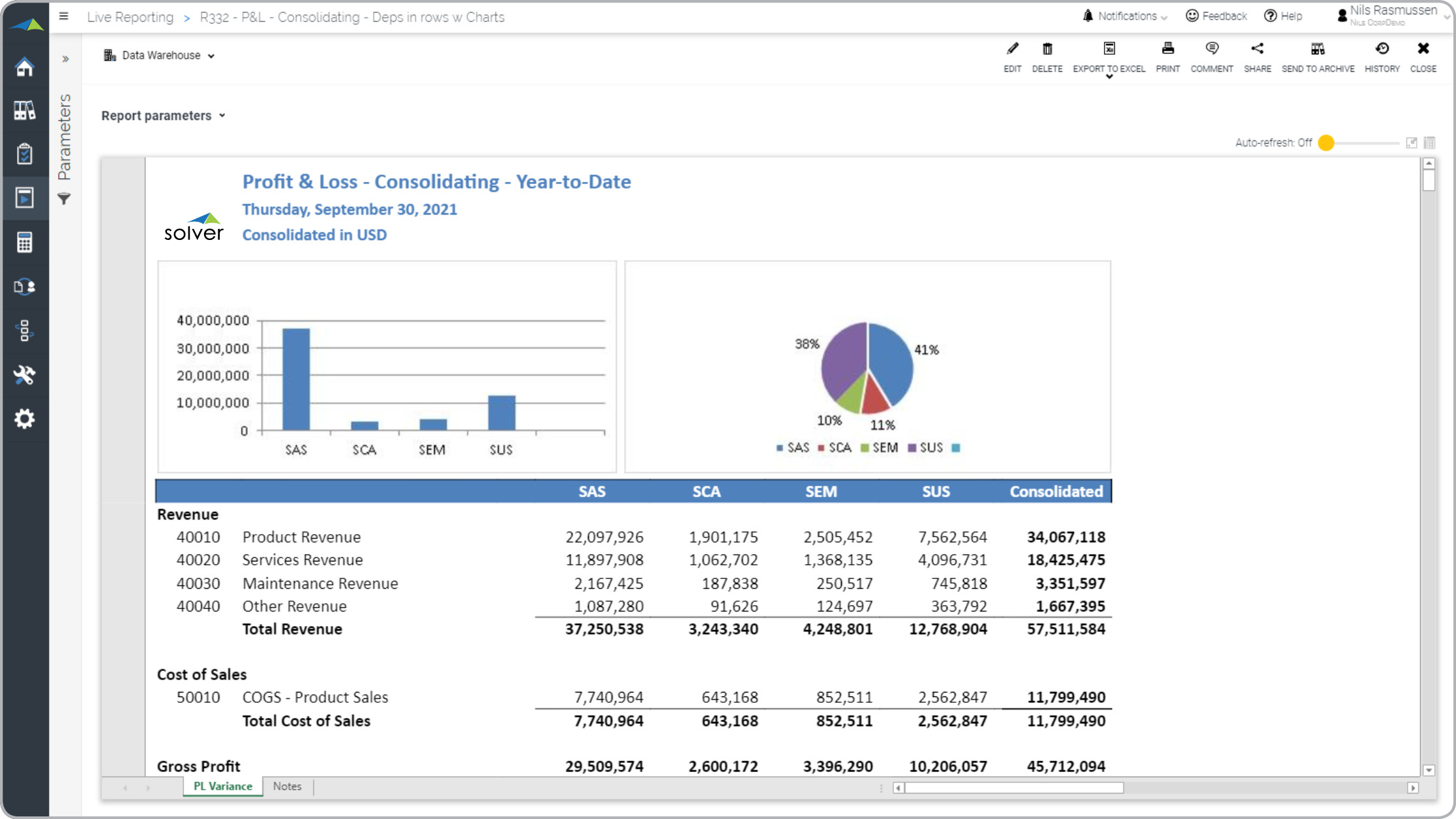

Let’s begin by explaining consolidations. Financial consolidations are aggregations of subsidiary transactional information to form a unified set of statements for a parent company. These reports are comprised of subsidiary data and directly showcase the parent company’s consolidated health. Financial consolidations often involve currency conversions with diverse money types, eliminations for inter-company transactions between subsidiaries, and any other adjustments that have to be performed manually without modern consolidation software. There are plenty of reasons to look at today’s consolidation solutions, but there are two simple reasons that are motivating some CFOs to look for a replacement. Your finance department might be thinking about an automated, modern consolidation tool for several reasons. Some are looking to get rid of their older software that are frankly too simple for today’s business needs, like manual Excel spreadsheet consolidations. Others are ready to retire their older programs that are simply too complex for business end users to manage, like Hyperion or Cognos TM1. Recently, I spoke with a CFO at a Sage Intacct customer who is responsible for managing the financials for an international parent company. He is regularly working with his team to perform currency conversions and to meet national and international regulations, such as the International Financial Reporting Standards (IFRS) to Generally Accepted Accounting Principles adjustments (GAAP), commonly referred to as IFRS to GAAP. Some consolidation software offer deep analysis with sub-ledgers and are part of a comprehensive of a Corporate Performance Management (CPM) platform, completely integrated with other solutions like

ad-hoc reporting,

planning processes,

data visualizations, and

BI data storage. Let’s zoom in on the specs of financial consolidations for Sage Intacct, specifically what you should know before beginning the search for the best consolidations tool for your team. This blog has covered different

data integration options before, but natively you could consolidate using the built-in reporting in Sage Intacct for real-time analysis, with the typical lack of flexible report design and in-depth consolidation features that all ERP systems suffer from, plus some potential sluggishness when it comes to data queries – depending on the size and how many queries are being performed simultaneously. Most third party consolidation solutions offer the option to integrate your data with the higher performance platform of a cloud-based CPM data store, but this method does require that you replicate your GL data from Sage Intacct to an online analytical processing (OLAP) cube or a data warehouse. Corporations with fewer subsidiary companies to consolidate, with simpler or no currency conversion necessary, and/or without the need to run substantial, simultaneous data queries would probably be fine with just the native consolidation within Sage Intacct. Additionally, if you are not expecting to pull in other data sources or EPRs for analysis, don’t need to perform advanced auto eliminations or other adjustments beyond what Sage Intacct can do, you could probably just rely on its internal functionality. On the other hand, plenty of CPM solutions upgrade the consolidation process by grabbing GL information right from Sage Intacct, so that option could be beneficial for parent companies who have complex and/or more needs. Replications to a cloud reporting data warehouse or an OLAP cube can be scheduled for routine refreshes – or you can manually export data over. Sage Intacct information will replicate, usually by way of a pre-built integration connecting to the Sage Intacct API interface that in turn will feed the warehouse or cube, and consolidations are produced at a higher performance level because of the strength and stability of a CPM data store. CPM data stores benefit companies with more complex conversions and adjustments, bigger and/or simultaneous data queries, and/or with a substantial amount of company data to consolidate. You should be evaluating what modern consolidation elements are requisite to perform your company’s specific consolidations. Let’s start with

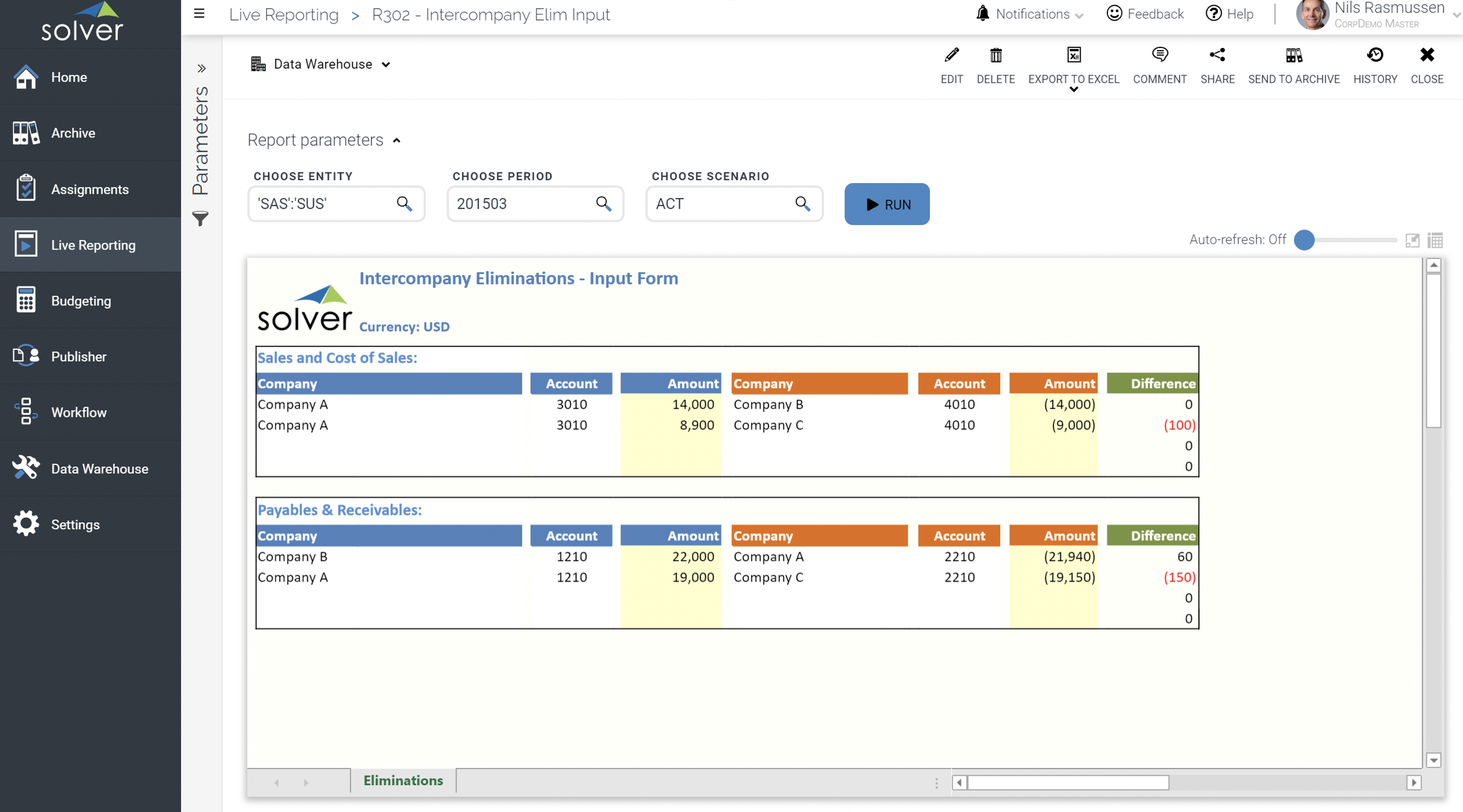

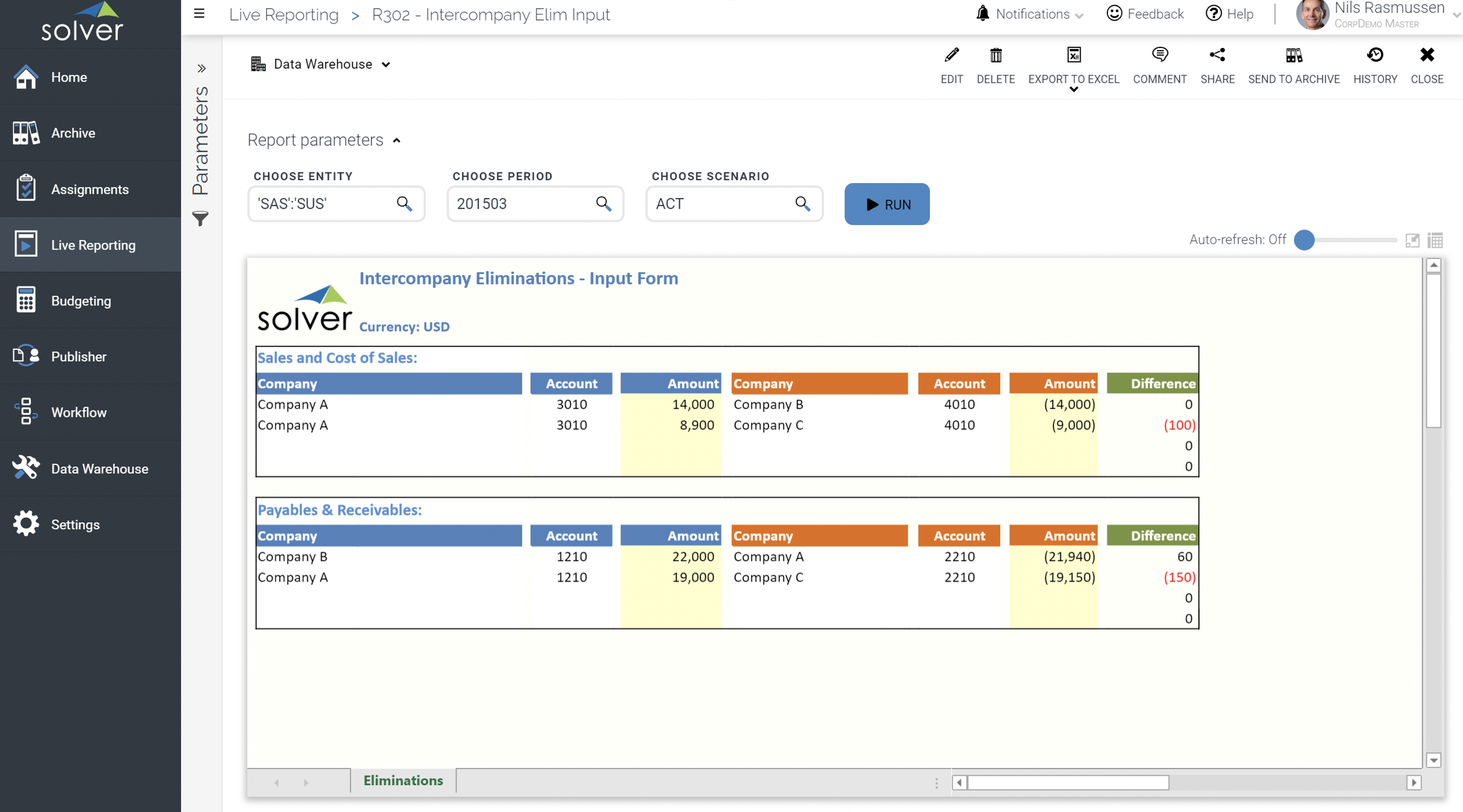

intercompany eliminations. Here and there, a subsidiary might buy or sell products or services from another subsidiary, which results in line items cancelling out. Intercompany elimination functionality removes these exchanges from the P&L and balance sheet because it is a re-allocation of internal resources, which you can perform with Sage Intacct or a CPM data store, via your implemented software. Some CPM solutions even offer configurable Excel input forms that you can use to manually cancel out or adjust inter-company transactions in simple ways.

Input form where user can enter manual elimination entries.

More of today’s powerful functionality:

currency conversion and

consolidation adjustments. Currency conversion is exactly what it sounds like: it translates multiple currencies into one currency for the unified set of reports. Consolidation adjustments empower accountants to meet national and international accounting standards, update inventory, and/or temporarily correct incomplete subsidiary information, amongst additional functions. Simply, these are adjustments that assist in the process of statutory statement submissions. And there are more consumer-driven functionality offerings.

Allocations, reconciliations, and

modeling organizational changes are more substantial features associated with today’s financial consolidation tools. Some organizations elect to allocate particular expenses or revenues to particular departments, divisions, and/or subsidiaries. These allocations can be performed within Sage Intacct, or there are some CPM data stores that allow you to build allocation processes of various complexity levels within the cube or warehouse.

What is the Effort to Implement a Reporting and Consolidation Solution for Sage Intacct? Most Sage Intacct customers want their connected apps, including CPM tools and dashboards, to be cloud based. Key questions that quickly come up are: how hard is it to integrate to Sage Intacct and how much cost and effort does it take to get up and running? The answer typically is weeks or months of effort and tens of thousands of dollars in services. However, Sage Intacct software partners, like

Solver, that work very closely with Sage and its partner channel, have developed pre-built integrations as well as out-of-the-box financial reports, planning input templates and Power BI dashboards. For example,

Solver’s QuickStart integration to Sage Intacct can get a company up and running in a single day with 100+ pre-built budget and forecast input templates, Power BI financial dashboards, as well as financial reports. All of these ready-to-use templates can be selected and downloaded at no additional cost from a continuously growing

Template Marketplace. If you choose to go with a CPM solution, plenty of organizations prefer to have either parent company or subsidiary staff reconcile data to ensure accuracy, which can be performed with Sage Intacct, CPM front-end software or both. Lastly, some data sources invite you to model divestments, acquisitions, and/or reorganizations by copying and altering infinite company trees or hierarchies that you need. You can see the effects of changes on the portfolio with this functionality. There’s plenty to think about in your shopping process, considering the complicated nature of consolidations. Solver, Inc. is happy to answer questions and generally review

Solver’s easy-to-use, Excel-powered

consolidation tool for Sage Intacct with both real-time or data warehouse integrated analysis, comprehensive reporting and collaboration as a way to accelerate company performance management.