Written by Nils R. | 3/31/23 7:00 AM

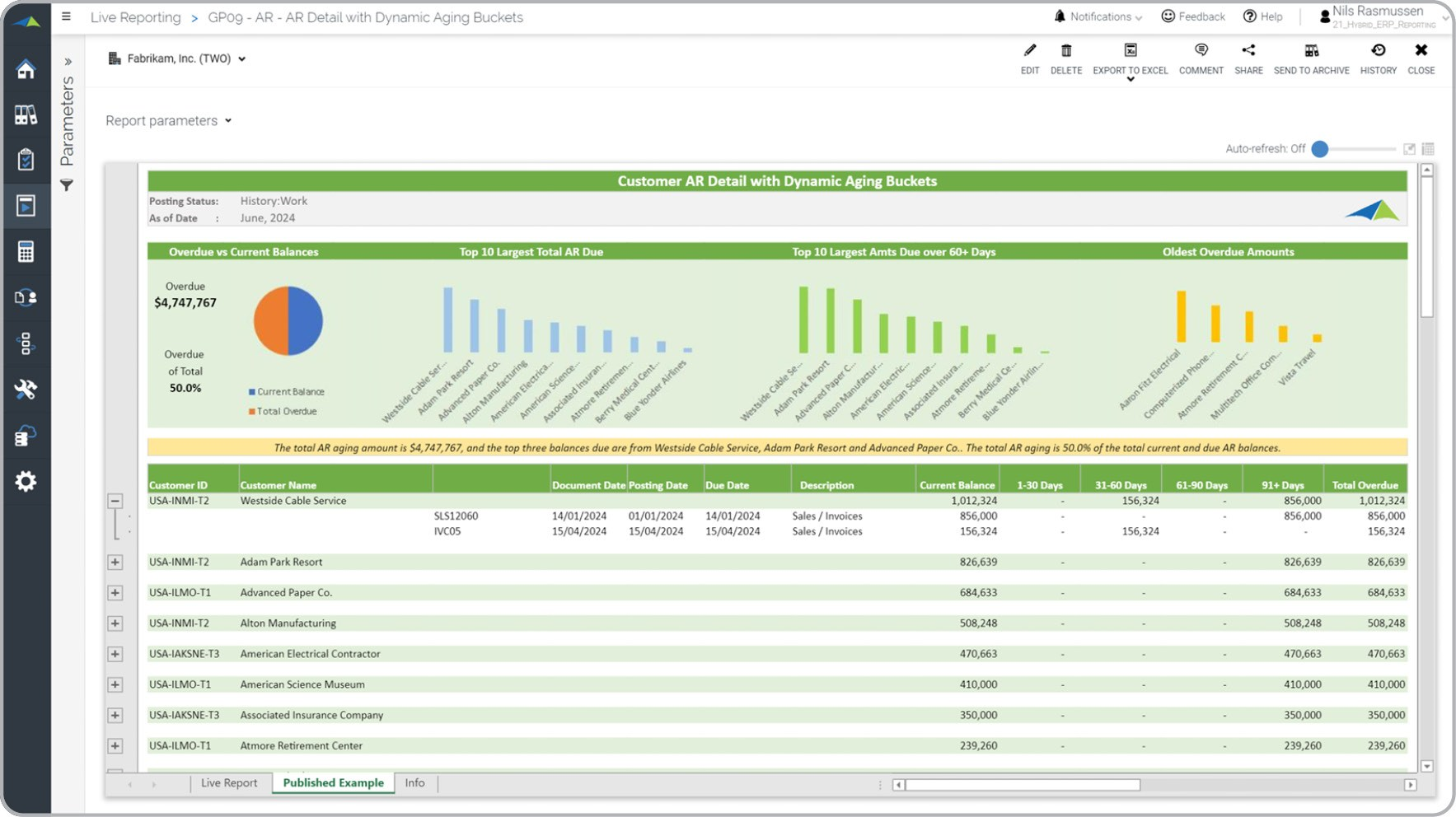

What does an Accounts Receivable Report with Dynamic Aging Buckets entail? An Accounts Receivable (AR) Aging report is an operational report used by accountants to identify customer balances that are past due. What sets this report apart is its ability to dynamically calculate and display outstanding amounts based on transaction dates within specific ranges, such as 0-30 days, 31-60 days, and so on. Unlike other reports, there is no need for users to first run an aging process in their ERP system. The example below provides a visual representation of this report.

What is the Purpose of AR Aging Reports? The purpose of AR Aging Reports is to help companies and organizations quickly identify customers who have outstanding payments. By incorporating this report into the Financial Planning & Analysis (FP&A) and Accounting Department's best business practices, the company can improve its liquidity and minimize the risk of customers defaulting on payments.

Benefits to Users Using an Accounts Receivable Report with Dynamic Aging Buckets offers several benefits to business users. This type of report allows users to easily identify past due customer balances and track outstanding amounts over time, giving a clear picture of the financial health of the company. With this information, business users can prioritize collections efforts and make decisions about resource allocation to ensure timely payments. Furthermore, the dynamic nature of the report streamlines the reporting process and provides real-time insights, helping users make better decisions and become more efficient in their daily tasks.

AR Aging Report

Example Here is an example of a modern AR Aging report with automatically calculated aging buckets.

You can find 100’s of additional examples

here

Who Uses This Type of

Report

? The typical users of this type of report are: CFOs, controllers and accountants.

Other

Report

s Often Used in Conjunction with

AR Aging Reports Most Financial Planning & Analysis (FP&A) and Accounting Departments use several different AR Aging Reports, along with sales transaction reports, accounts payable (AP) reports and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Netsuite and others. In analysis where budgets or forecasts are used, the data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

- Native ERP report writers and query tools

- Spreadsheets (for example Microsoft Excel)

- Corporate Performance Management (CPM) tools (for example Solver)

- Dashboards (for example Microsoft Power BI and Tableau)

- View 100’s of reporting, consolidations, planning, budgeting, forecasting and dashboard examples here

- Discover how the Solver CPM solution delivers financial and operational reporting

- Discover how the Solver CPM solution delivers planning, budgeting and forecasting

- Watch demo videos of reporting, planning and dashboards