How to Quickly Reforecast the Company Budget When the Unexpected Happens

It is easy to predict the future when it is business as usual. However, if your business environment is suddenly impacted by something like the coronavirus, a delayed product launch or an unplanned acquisition, your corporate budget may become obsolete very quickly.

How Do I Know it is Time To Replace the Budget with a Forecast?

Sometimes unexpected events happen and it is clear the company’s actual performance is moving so far above or below the annual budget that it no longer provides value in the following ways:

- A cost control tool

- A target for employee compensation plans

- A detailed financial break-down of corporate strategic goals

- A financial plan for various corporate initiatives

There are many signs that you need to create a budget reforecast because it is becoming obsolete due to unexpected events, such as:

- Management comments why a revenue or expense budget variance is occurring

- Complaints from sales teams that their targets are too high due to XYZ event

- Lack of budget ownership from department heads

In addition, you will start hearing from executives that the budget column in the financial statements is “useless” or that the budget target figure in aKey Performance Indicator (KPI) is no longer valuable.

Some organizations have a predefined monthly, quarterly or semi-annual reforecasting process, and when the unexpected happens, they simply take this into account next time they reforecast. These companies often have budgeting and forecasting software such as Solver, Adaptive Insight or Planful to speed up and automate the time and effort it takes to create budgets and forecasts.

Other organizations’ forecasting techniques only include a single annual budget version as a baseline, and for these companies a “forced” reforecast due to unexpected events might involve a lot more arms and legs and interruptions to people’s work schedules.

What to do When the Corporate Budget Becomes Obsolete?

Companies generally do one of the following when their budgets become obsolete:

- Do nothing and live with the undocumented comments and questions until next year’s budget is launched

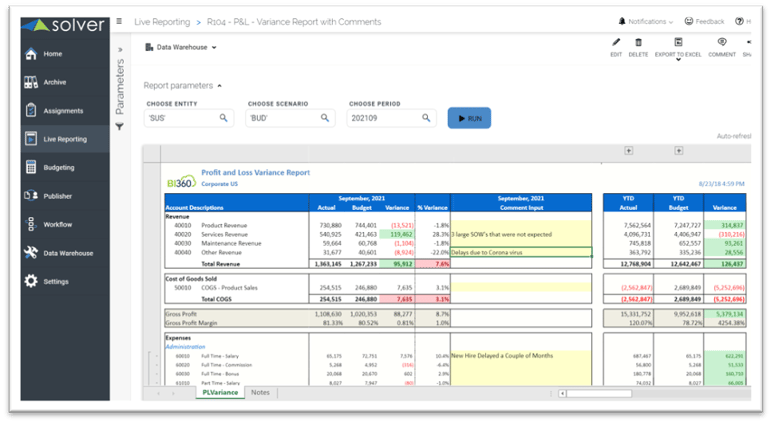

- Leave the budget as is and use report comments to explain big budget variances (see sample screenshot below).

- Reforecast the rest of the year and replace the now defunct budget with the new forecast

Most companies enter their corporate forecasts at a higher level than the annual budget, and often it is only done at the Profit & Loss account level and sometimes also for Balance Sheet and Cash Flow.

In most cases, smaller organizations with well organized, home-grown Excel models can forecast in their spreadsheet and then re-import the forecast into their ERP system or third-party reporting tool. In mid-sized and larger organizations even forecasts at the GL account level may require a lot of work due to requirements to do this by division or department. These companies either have more human resources available to perform the work or they use a budgeting tool to automate it.

How to Reforecast Your Budget?

Whether your forecasting requirements are simple enough to be handled in Excel or your company is using a modern budgeting tool, there are ways to avoid the painfully slow bottom-up data entry process. The problem with the latter is that the new forecast may already be old by the time you are done. In these cases, the unexpected event that led to the reforecast could have changed again, leading you to start all over.

Budgeting and forecasting software automation typically means that your input model is highly formula driven. For example, your forecast model can rapidly calculate all the required entries automatically such as % Revenue Increase, Target Net Income, Reduction/Increase in Headcount, etc. This functionality has many names such as:

- Top-down planning

- Driver-based modelling

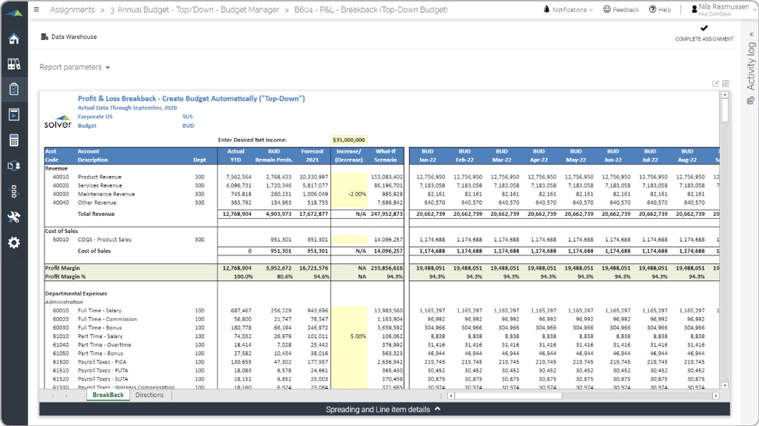

- Break-back modelling (see sample screenshot below)

- What-if analysis

Regardless of what you call it and the type of planning tool you use, an automated reforecasting model can create an entire forecast in minutes or hours versus days or weeks with manual methods.

An automated model also allows you to create multiple scenarios. For example, armed with a “Best Case”, “Worst Case” or “Likely” forecast scenarios, you can be prepared for unexpected events without rushing to reforecast. Instead, you replace the “Likely” budget version with the already created “Best Case” or “Worst Case” scenario and you are done.

If the situation calls for a brand new scenario, you adjust the drivers in the automated model and it will recalculate and store the underlying account-level forecast transactions.

When your company has the right tools and plans ready for a budget reforecast they will be prepared for a virus outbreak, stock market crash or exciting acquisition of a competitor. Planning ahead will reduce stress and blood pressure for the organization’s finance team.

Request a DemoTAGS: Reporting, Forecasting, Budgeting, ERP, FP&A, Financial Reporting

Global Headquarters

Solver, Inc.

Phone: +1 (310) 691-5300