Monthly Cash Flow Forecast Model for Dynamics 365 Business Central

What is

a

Monthly Cash Flow Forecast Model

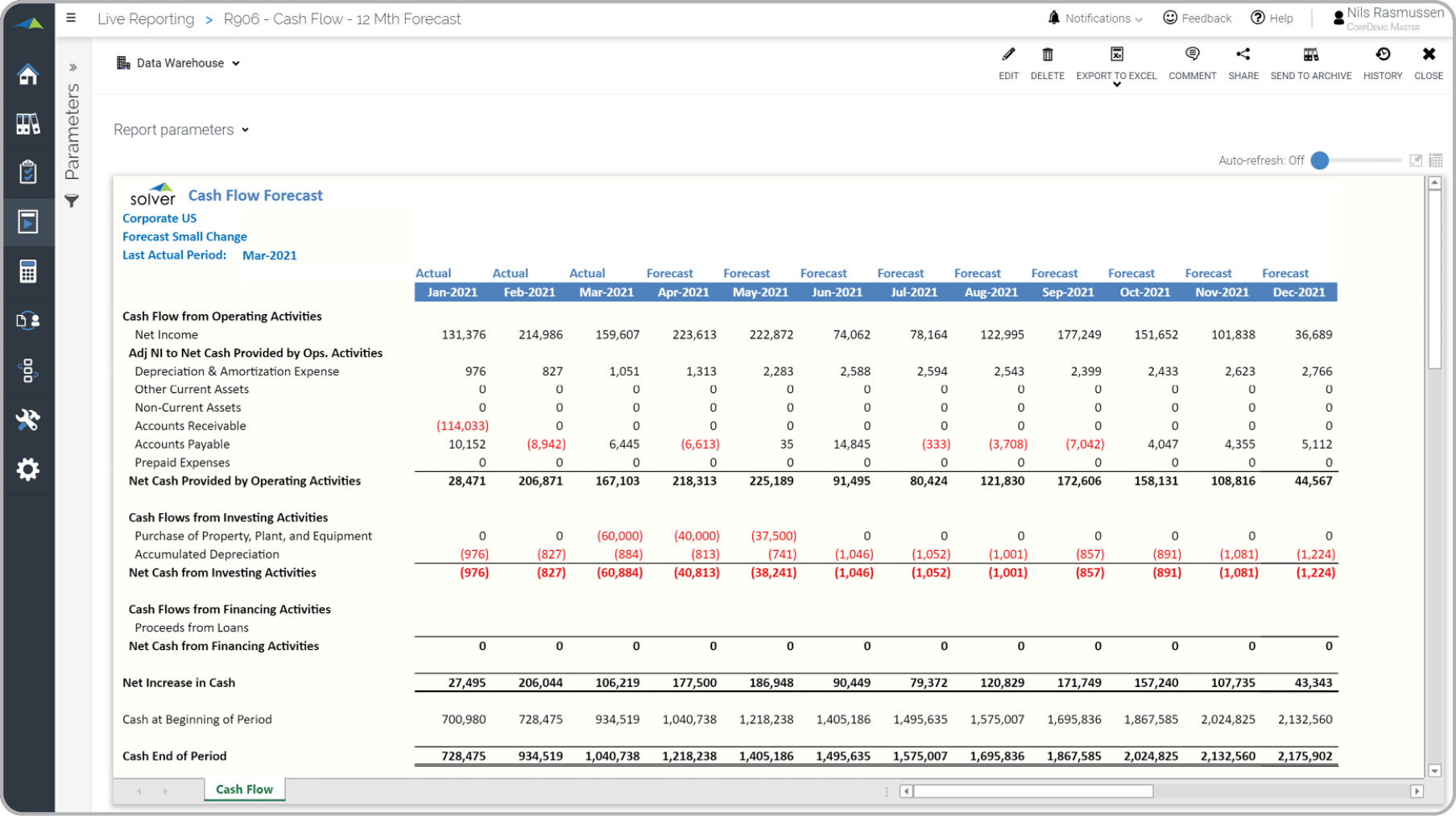

? A Monthly Cash Flow Forecast Model is a vital planning tool used by CFOs and planning managers to ensure sufficient liquidity for future operations. This template retrieves data from Profit & Loss and Balance Sheet accounts, displaying monthly historical data YTD and forecasts for the remaining periods of the year. It incorporates asset and liability accounts to predict the timing of Receivables and Payables, providing insights into cash flow trends. An example of this forecast template is provided below.

Purpose of

Cash Flow Forecast Models Cash Flow Forecast Models serve the purpose of helping companies and organizations ensure they have enough cash to fund planned activities in the coming months. By incorporating them into Financial Planning & Analysis (FP&A) practices, businesses can enhance liquidity and minimize the risk of cash flow issues.

Benefits to Users Implementing a Monthly Cash Flow Forecast Model offers significant benefits to business users, enabling them to make informed decisions and improve their efficiency in their roles. By having a clear view of projected cash flows, users can identify potential gaps or surpluses in funding and adjust their strategies accordingly. They can proactively plan for necessary financing or investment opportunities, optimizing the allocation of resources and capital. Additionally, the detailed insights provided by the model, such as cash flow trends and patterns, allow users to identify areas for cost savings, streamline operations, and enhance overall financial performance. This empowers business users to make better decisions, mitigate risks, and drive greater efficiency in their day-to-day responsibilities.

Cash Flow Forecast Model

Example Here is an example of a Monthly Cash Flow Forecast Report with actual data year-to-date and forecast for the rest of the year.

You can find hundreds of additional examples

here.

Who Uses This Type of

Forecast Template

? The typical users of this type of forecast template are: CFOs and Executives.

Other

Forecast Template

s Often Used in Conjunction with

Cash Flow Forecast Models Progressive Financial Planning & Analysis (FP&A) Departments sometimes use several different Cash Flow Forecast Models, along with profit & loss and balance sheet forecasts and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

- Native ERP report writers and query tools

- Spreadsheets (for example Microsoft Excel)

- Corporate Performance Management (CPM) tools (for example Solver)

- Dashboards (for example Microsoft Power BI and Tableau)

- View 100’s of reporting, consolidations, planning, budgeting, forecasting and dashboard examples here

- Discover how the Solver CPM solution delivers financial and operational reporting

- Discover how the Solver CPM solution delivers planning, budgeting and forecasting

- Watch demo videos of reporting, planning and dashboards

TAGS: Reporting, Forecasting, Budgeting, CPM, ERP, Financial Reporting, Template Library

Global Headquarters

Solver, Inc.

Phone: +1 (310) 691-5300