Related Posts

BLOG HOME

- How the Solver Contributor User Expands Budget Planning Beyond Finance

- Better Reporting Leads to Better Business Decisions

- Advanced Planning Tools Foster Business Success

- xFP&A Software for Financial Consolidation Drives Intelligent Decisions

- Best Practices in Creating Consolidated Financial Statements

Intercompany Matching Report for Dynamics 365 Business Central

What is

a

Intercompany Matching Report

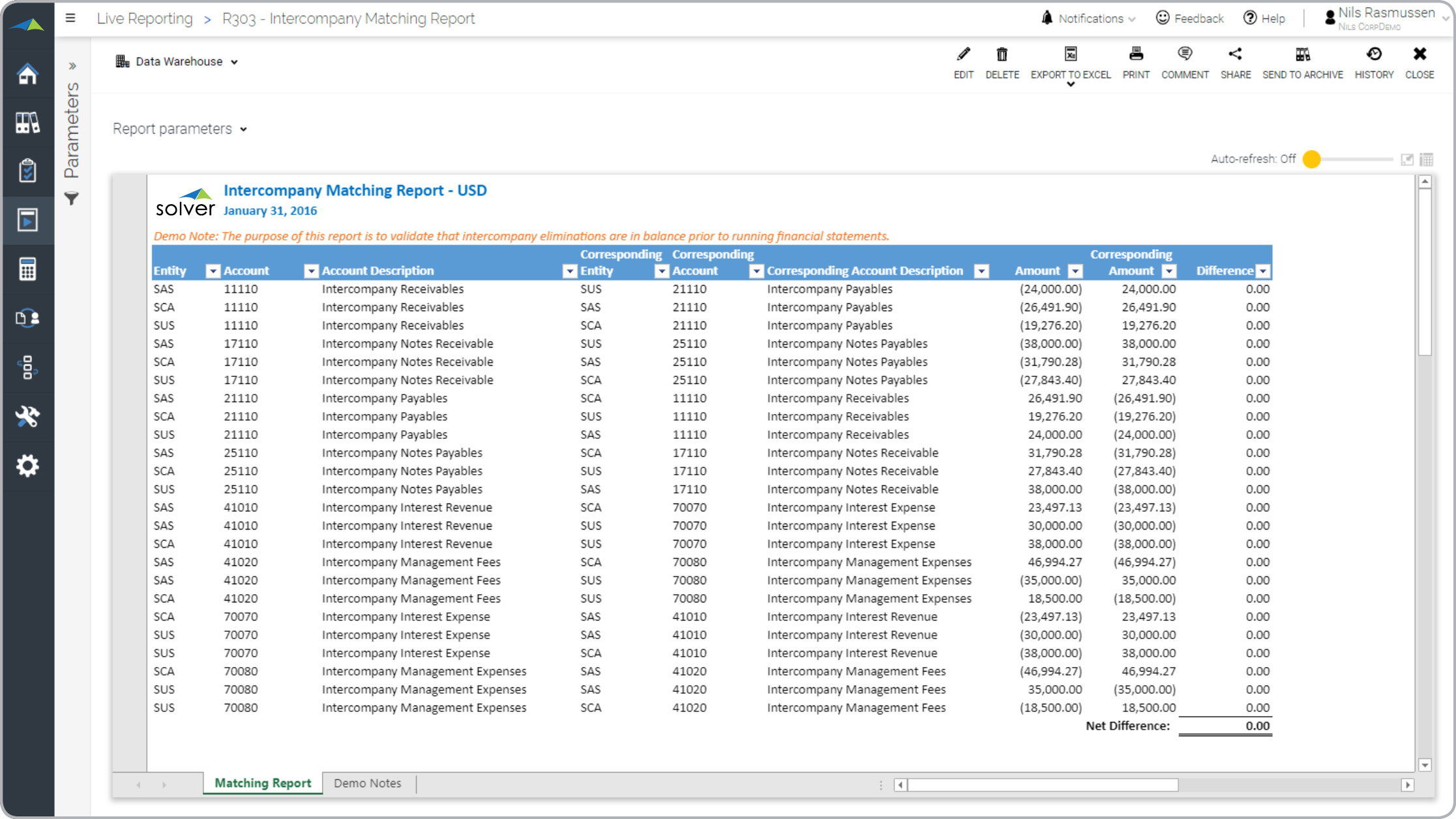

? An Intercompany Matching Report is a crucial tool used during the month-end close process in multi-company enterprises. It helps Group Controllers identify and reconcile transactions between subsidiaries. This report automatically detects and presents due-to and due-from transactions, allowing controllers to easily compare and identify any discrepancies. The report displays matching transactions from each company on the same row, with a variance column indicating the degree of match. Below is an example of such a consolidation report.

Purpose of

Intercompany Matching Reports The purpose of Intercompany Matching Reports is to streamline the month-end close process for companies and organizations. Particularly for businesses with multiple subsidiaries and internal transactions, these reports play a vital role in the accounting team's operations. By incorporating this report into their Finance & Accounting Department's practices, companies can enhance the efficiency and accuracy of their month-end consolidation process, minimizing the risk of errors that could result in incorrect financial statements.

Benefits to Users Intercompany Matching Reports offer significant benefits to business users, enabling them to make informed decisions and enhance their efficiency in day-to-day operations. By providing a clear and consolidated view of intercompany transactions, these reports enable users to identify any discrepancies or inconsistencies quickly. This helps in addressing issues promptly and making necessary adjustments. With accurate and up-to-date information readily available, users can confidently analyze financial data and gain insights into the overall financial health of the organization. Moreover, the streamlined month-end close process facilitated by these reports saves time and effort for users, allowing them to focus on value-added tasks and strategic decision-making. Ultimately, leveraging Intercompany Matching Reports empowers business users to improve decision-making, optimize resource allocation, and contribute to the overall success of the organization.

Intercompany Matching Report

Example Here is an example of an Intercompany Report that automatically matches sales, purchases, payables and receivables.

You can find hundreds of additional examples

here.

Who Uses This Type of

Consolidation Report

? The typical users of this type of consolidation report are: Controllers and Accountants.

Other

Consolidation Report

s Often Used in Conjunction with

Intercompany Matching Reports Progressive Finance & Accounting Departments sometimes use several different Intercompany Matching Reports, along with consolidated profit & loss, balance sheet and cash flow reports and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

- Native ERP report writers and query tools

- Spreadsheets (for example Microsoft Excel)

- Corporate Performance Management (CPM) tools (for example Solver)

- Dashboards (for example Microsoft Power BI and Tableau)

- View 100’s of reporting, consolidations, planning, budgeting, forecasting and dashboard examples here

- Discover how the Solver CPM solution delivers financial and operational reporting

- Discover how the Solver CPM solution delivers planning, budgeting and forecasting

- Watch demo videos of reporting, planning and dashboards

Global Headquarters

Solver, Inc.

Phone: +1 (310) 691-5300