Written by Nils R. | Nov 24, 2021 8:00:00 AM

How can

Financial Dashboard

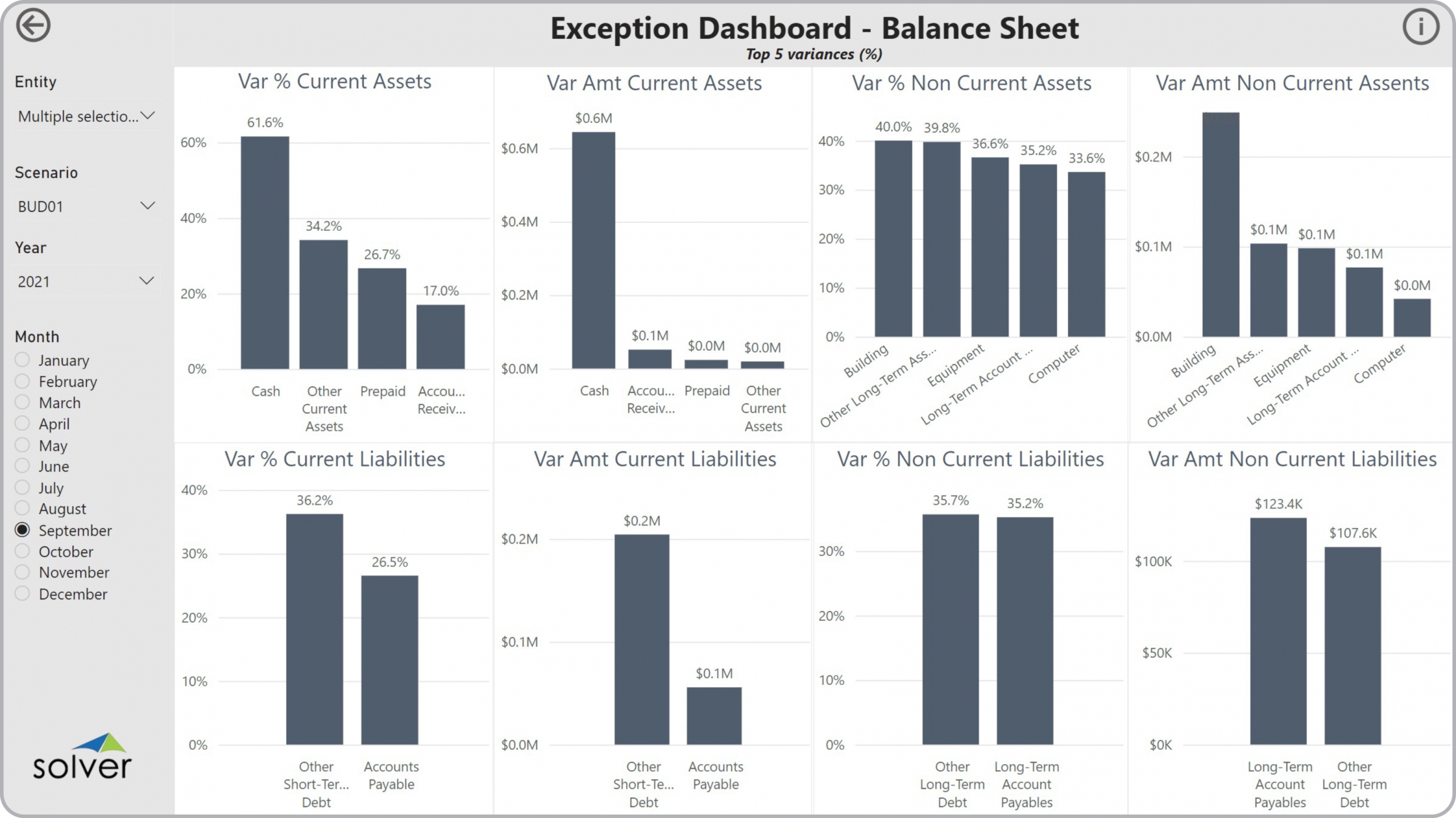

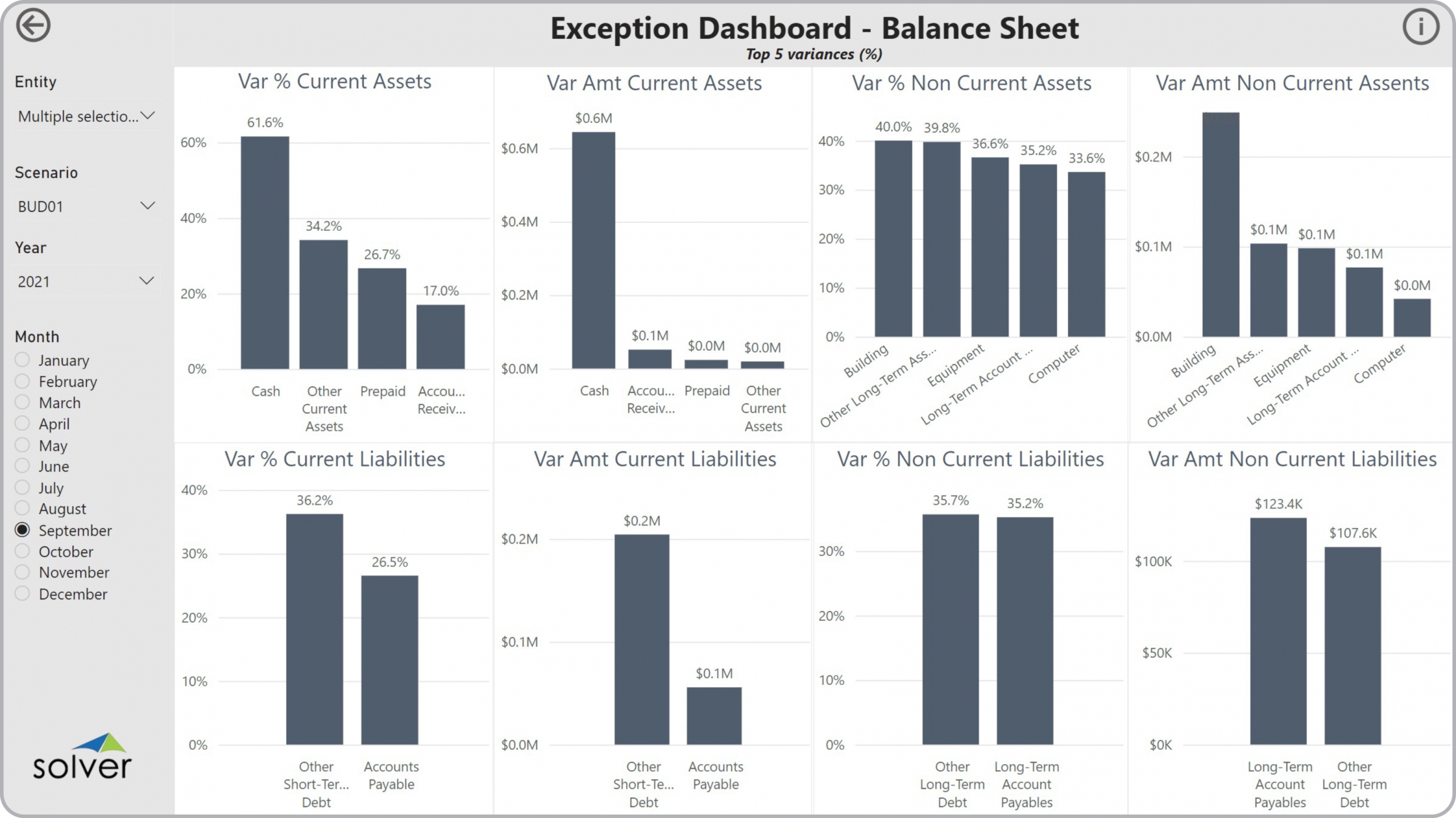

s Drive Faster and Better Decisions? As CFOs increasingly become key players in the Monthly Analysis Process, they must rely on modern self-service corporate performance management (CPM) and business intelligence (BI) tools. Using interactive Financial Dashboards like the Balance Sheet Exception Dashboard template shown below enables them and users from the leadership team to experience near real time asset and liability outliers that help drive faster and better decisions.

Who uses

Balance Sheet Exception Dashboard

s and What are Some Key Analytical Features? In today’s fast-paced business environment, CFOs are under high pressure to supply end users like finance team members and analysts with timely and concise Financial Dashboards. Companies use key features like the ones below to support their users with effective analysis that helps drive fiscal control and planning.

- Top five variances versus prior year for current and non-current assets and liabilities

- Top five GL account level variances for all assets and liabilities

- Ranked charts based on amount of variance vs prior year

- Templates from Solver that are pre-built and that work out-of-the-box using the Solver CPM cloud. Click here.

- Template examples: You find more than 500 CPM and BI Template examples here.

- Interactive Dashboard examples: Try Power BI dashboard templates from Solver here.

- Software evaluation and selection:

- Vendor Comparison and ROI (free interactive tool)

- Evaluating planning, budgeting and forecasting functionality

- Evaluating Financial Reporting functionality

- Evaluating Dashboard functionality

- Evaluating Data Warehouse functionality to achieve “one version of the truth”

- Demonstrations and other specific assets: Solver Tour Central

- Using third party analysts and consultants to aid in vendor selection

- Creating efficient processes: