Written by Nils R. | Aug 7, 2020 7:00:00 AM

What is

a

Narrative Profit & Loss Report

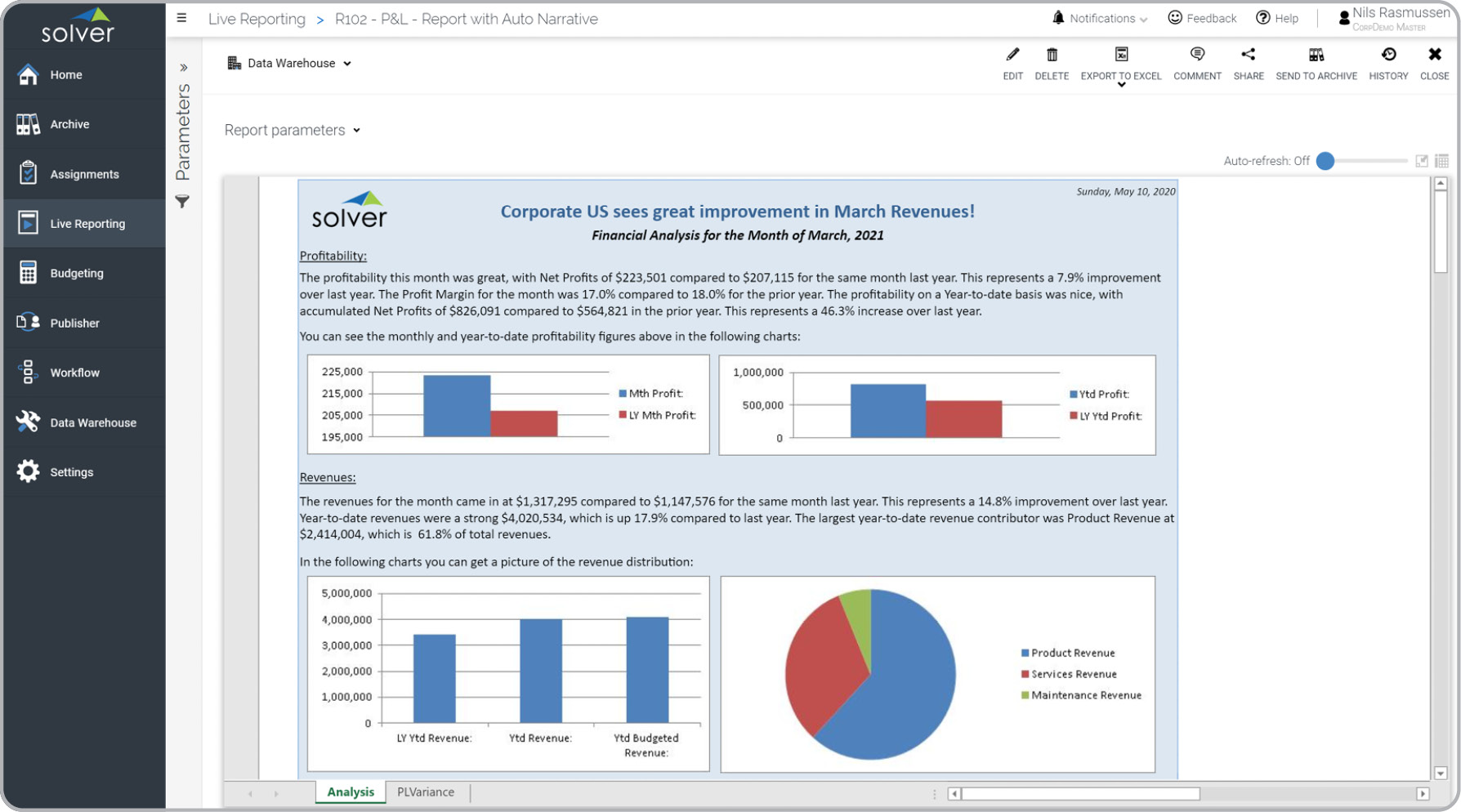

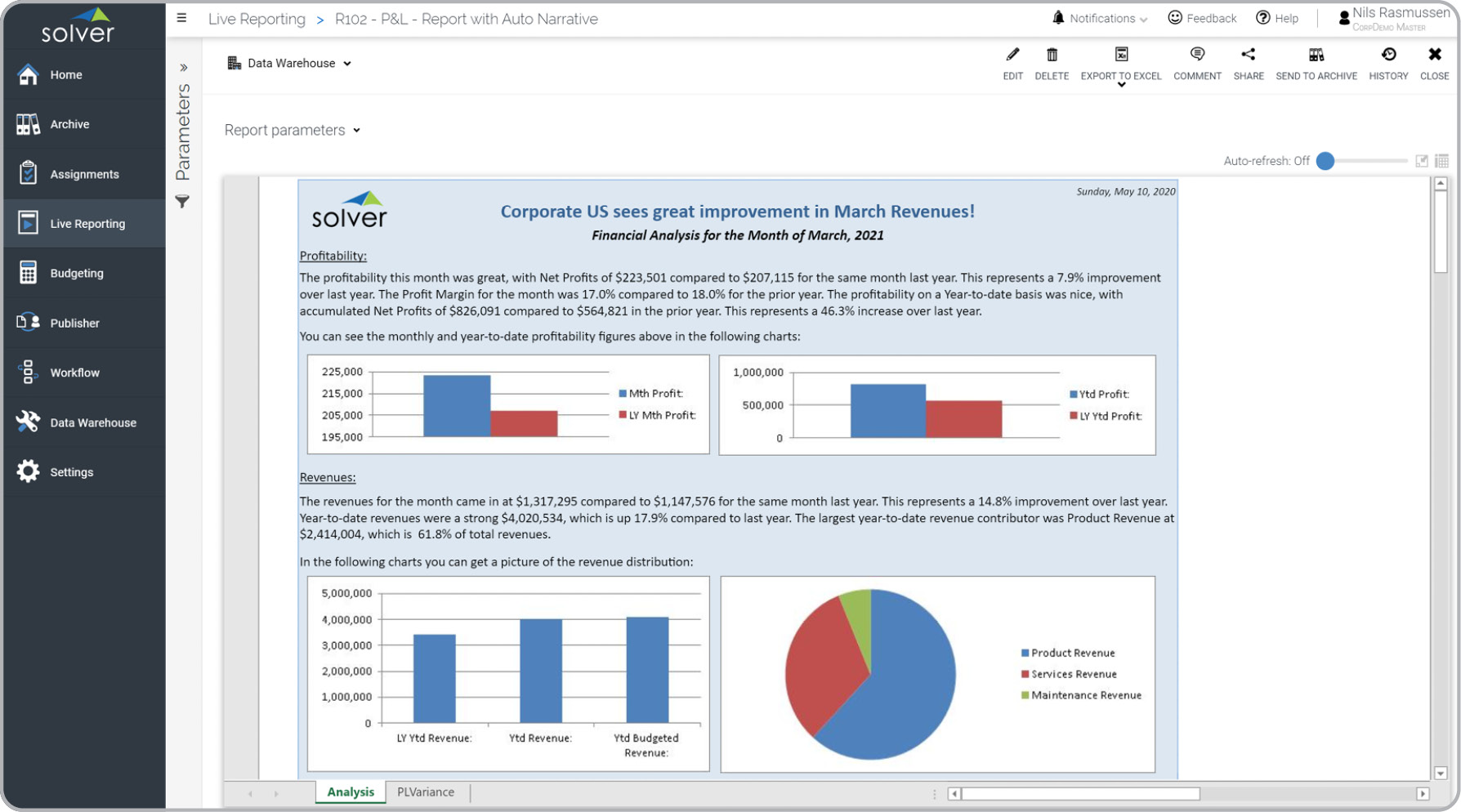

? Narrative Financial Reports are considered easy-to-read financial summaries and are often used by Financial Analysts and CFOs to provide end users with a very easy-to-read, newspaper-like cover page for their Profit & Loss and other number-intense reports. One key functionality in this type of innovative report updates all the text, inserted numbers and charts automatically. All the user has to do is run the report for the desired month and the text will refresh with the right data. Even adjectives in headers and text will change based on business rules. The underlying numerical report is presented on the second tab. You will find an example of this type of innovative report below.

Purpose of

Narrative Financial Reports Companies and organizations use Narrative Financial Reports to give executives and managers that are not financial experts a very easy and user-friendly format to interpret financial results. When used as part of good business practices in a Financial Planning & Analysis (FP&A) Department, a company can improve its ability to drive interest and analytical capabilities outside of the finance team, as well as, reduce the chance that other departments and executives miss the monthly financial highlights.

Narrative Financial Report

Example Here is an example of an automatically generated Narrative Profit & Loss Report with the detailed financial statement on the second page.

- Native ERP report writers and query tools

- Spreadsheets (for example Microsoft Excel)

- Corporate Performance Management (CPM) tools (for example Solver)

- Dashboards (for example Microsoft Power BI and Tableau)

- View 100’s of reporting, consolidations, planning, budgeting, forecasting and dashboard examples here

- See how reports are designed in a modern report writer using a cloud-connected Excel add-in writer

- Discover how the Solver CPM solution delivers financial and operational reporting

- Discover how the Solver CPM solution delivers planning, budgeting and forecasting

- Watch demo videos of reporting, planning and dashboards