Written by Nils R. | Jul 4, 2020 7:00:00 AM

What is

a

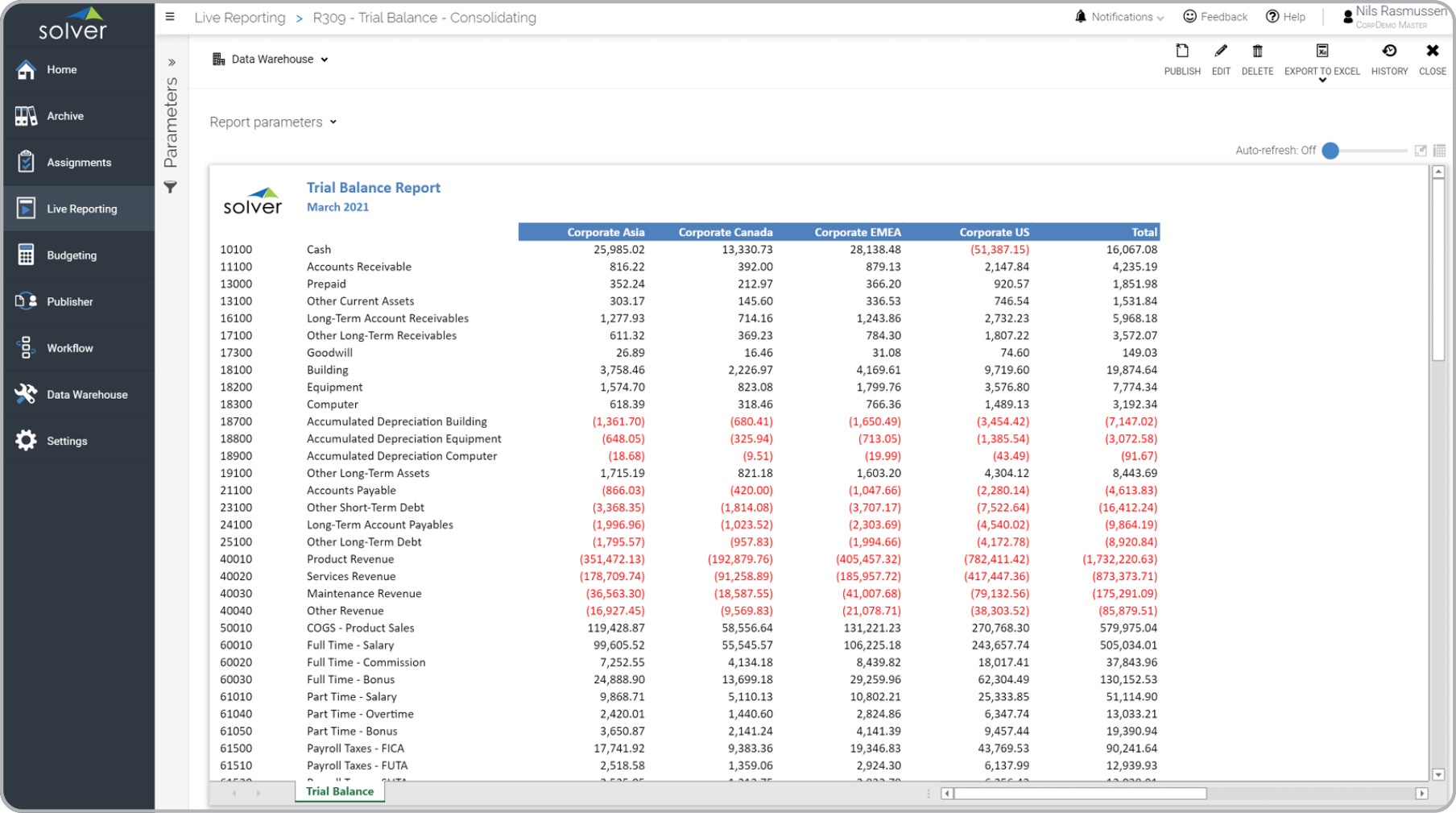

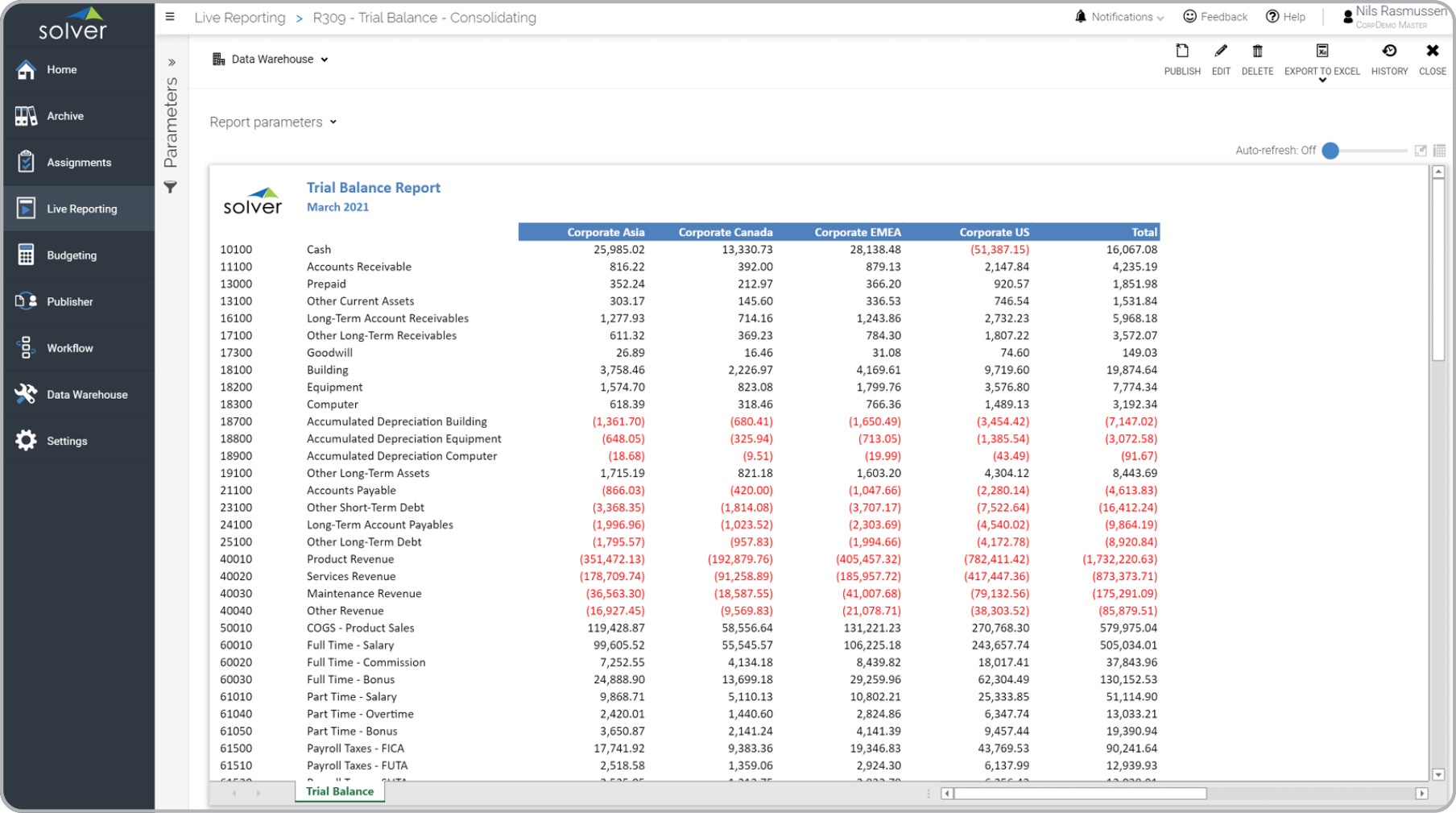

Consolidating Trial Balance

? Consolidating Trial Balance Reports are considered essential control tools and are used by Group Controllers to ensure that the financial transactions supplied from subsidiaries are in balance. A key functionality in this type of consolidation report lists all financial accounts down the rows with a total that should be zero if everything is correct. Each subsidiary is listed in the columns along with a grand total. The report can be run by each division for their own sub-consolidation as well as for the corporate HQ for its divisions. Drill-down is important so that the controller can easily explore underlying transactions when needed. You will find an example of this type of consolidation report below.

Purpose of

Consolidating Trial Balance Reports Companies and organizations use Consolidating Trial Balance Reports to ensure that all subsidiary data is in balance before the rest of the consolidation process continues. When used as part of good business practices in a Finance & Accounting Department, a company can improve its ability to catch problems and improve the closing process, as well as, mitigate the risk that out-of-balance subsidiary data will slow down the time to deliver consolidated financials.

Consolidating Trial Balance Report

Example Here is an example of a Consolidating Trial Balance report. [caption id="" align="alignnone" width="1808"]

- Native ERP report writers and query tools

- Spreadsheets (for example Microsoft Excel)

- Corporate Performance Management (CPM) tools (for example Solver)

- Dashboards (for example Microsoft Power BI and Tableau)

- View 100’s of reporting, consolidations, planning, budgeting, forecasting and dashboard examples here

- Discover how the Solver CPM solution delivers financial and operational reporting

- Discover how the Solver CPM solution delivers planning, budgeting and forecasting

- Watch demo videos of reporting, planning and dashboards