Related Posts

BLOG HOME

- Headcount Dashboard for SaaS Companies using Dynamics 365 Business Central

- Top 50 Opportunities Report for SaaS Companies using Dynamics 365 BC

- Subscription Sales by Contract Length Report for SaaS Companies using Dynamics 365 Business Central

- Lead Target Model for SaaS Companies using Dynamics 365 Business Central

- Cap Table Template for SaaS Companies using Dynamics 365 Business Central

Consolidated Accounts Receivable Report

What is

a

Consolidated Accounts Receivable Report

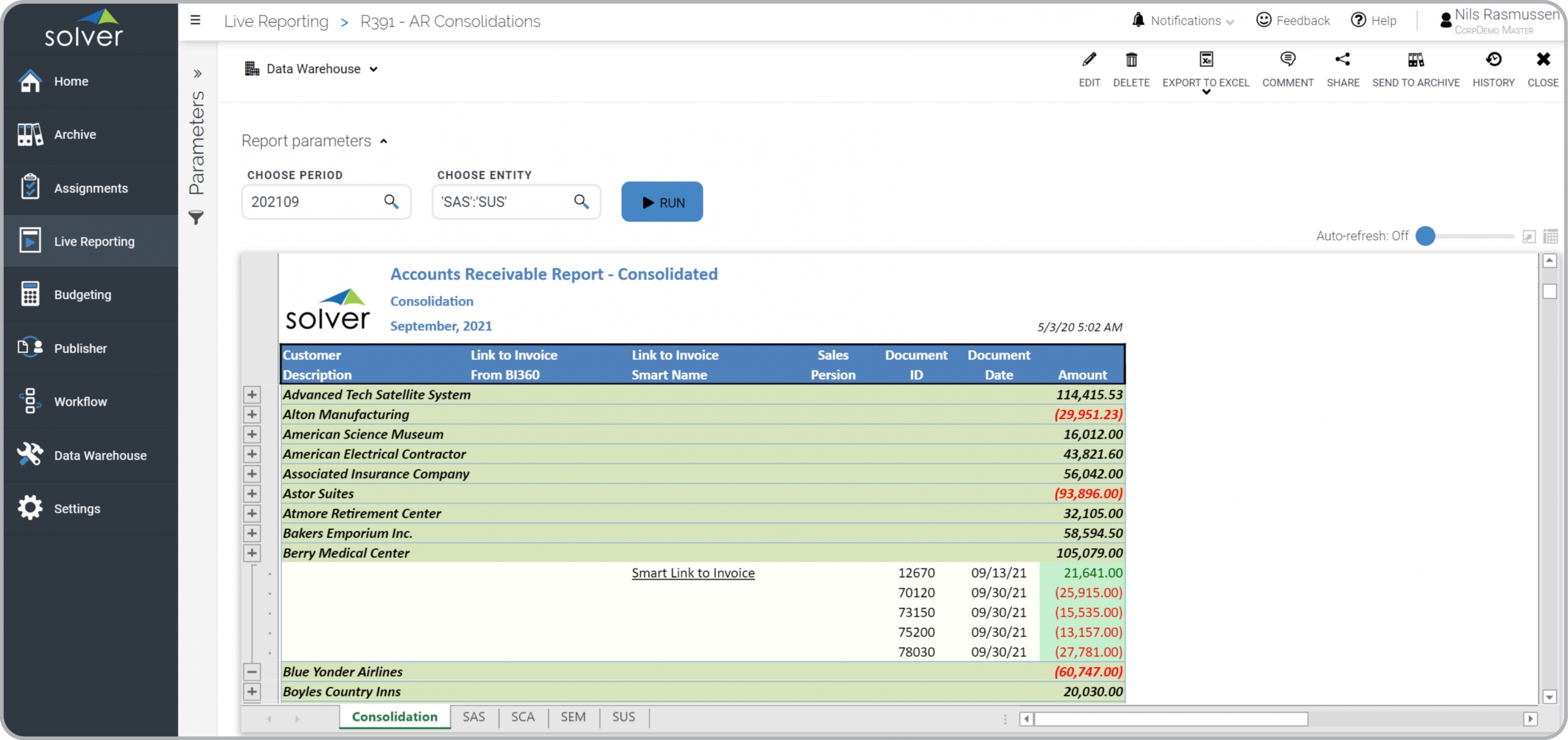

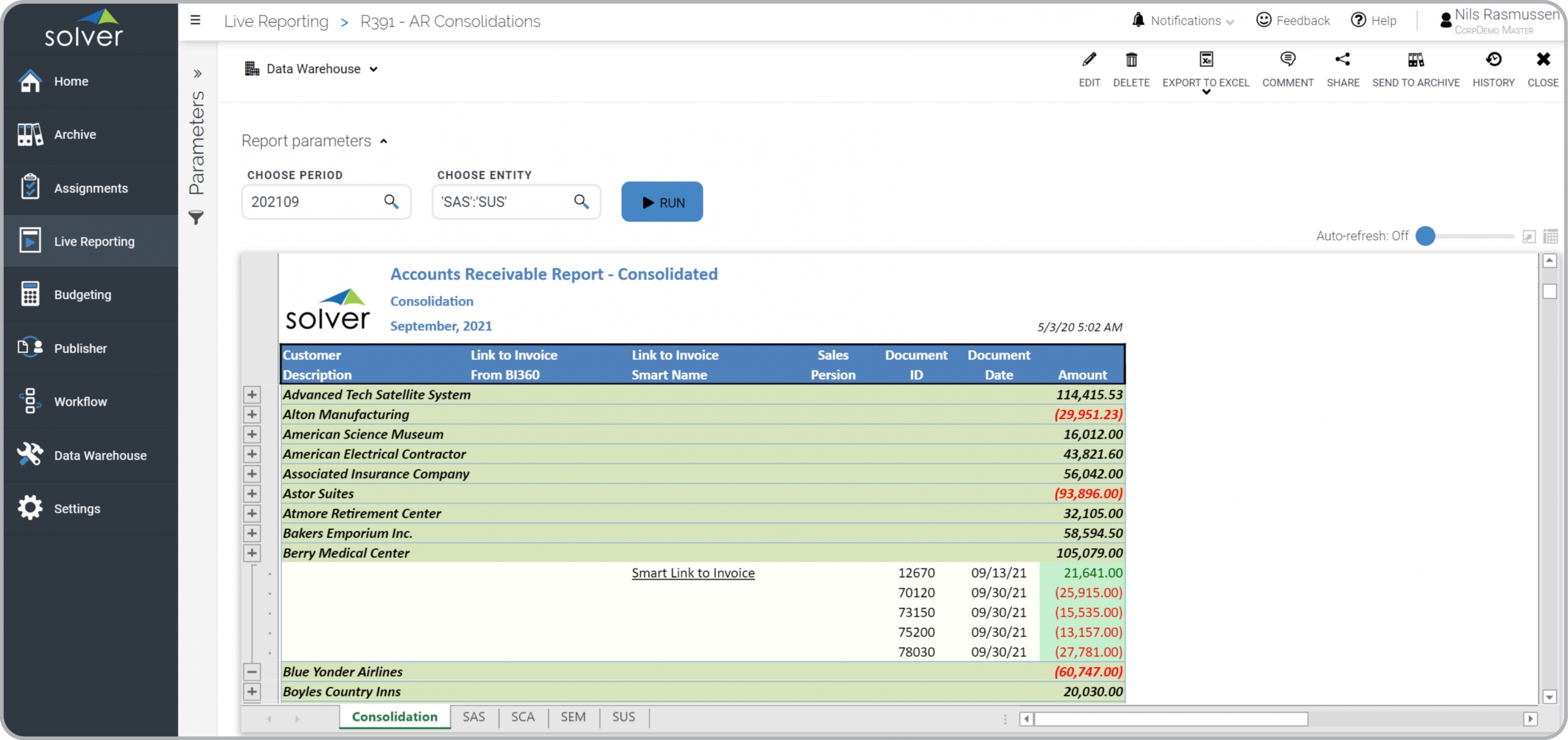

? Consolidated Accounts Receivable (AR) reports are considered month-end consolidation tools and are often used by accountants to get a summarized picture of receivables from the company's customers. Key functionality in this type of report shows the consolidated accounts receivable (AR) amounts by customer on the first tab, and AR by subsidiary in the following tabs. Each row in the report can be expanded to see individual receivables transactions by customer. You will find an example of this type of report below.

Purpose of

Consolidated Accounts Receivable Reports Companies and organizations use Consolidated Accounts Receivable Reports to easily review the total outstanding amount they have with each customer. When used as part of good business practices in a Finance & Accounting Department, a company can improve its liquidity, as well as, mitigating customers flagged as "high risk" level or unpaying.

Consolidated Accounts Receivable Report

Example Here is an example of a Consolidated Accounts Receivable Report. [caption id="" align="alignnone" width="2560"]

Consolidated Accounts Receivable (AR) Report Example[/caption] You can find hundreds of additional examples

here.

Who Uses This Type of

Report

? The typical users of this type of report are: Group Controllers and Accountants.

Other

Report

s Often Used in Conjunction with

Consolidated Accounts Receivable Reports Progressive Finance & Accounting Departments sometimes use several different Consolidated Accounts Receivable Reports, along with AR Aging reports, consolidated accounts payable reports, sales reports and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

Consolidated Accounts Receivable (AR) Report Example[/caption] You can find hundreds of additional examples

here.

Who Uses This Type of

Report

? The typical users of this type of report are: Group Controllers and Accountants.

Other

Report

s Often Used in Conjunction with

Consolidated Accounts Receivable Reports Progressive Finance & Accounting Departments sometimes use several different Consolidated Accounts Receivable Reports, along with AR Aging reports, consolidated accounts payable reports, sales reports and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

Consolidated Accounts Receivable (AR) Report Example[/caption] You can find hundreds of additional examples

here.

Who Uses This Type of

Report

? The typical users of this type of report are: Group Controllers and Accountants.

Other

Report

s Often Used in Conjunction with

Consolidated Accounts Receivable Reports Progressive Finance & Accounting Departments sometimes use several different Consolidated Accounts Receivable Reports, along with AR Aging reports, consolidated accounts payable reports, sales reports and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

Consolidated Accounts Receivable (AR) Report Example[/caption] You can find hundreds of additional examples

here.

Who Uses This Type of

Report

? The typical users of this type of report are: Group Controllers and Accountants.

Other

Report

s Often Used in Conjunction with

Consolidated Accounts Receivable Reports Progressive Finance & Accounting Departments sometimes use several different Consolidated Accounts Receivable Reports, along with AR Aging reports, consolidated accounts payable reports, sales reports and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

- Native ERP report writers and query tools

- Spreadsheets (for example Microsoft Excel)

- Corporate Performance Management (CPM) tools (for example Solver)

- Dashboards (for example Microsoft Power BI and Tableau)

- View 100’s of reporting, consolidations, planning, budgeting, forecasting and dashboard examples here

- Discover how the Solver CPM solution delivers financial and operational reporting

- Discover how the Solver CPM solution delivers planning, budgeting and forecasting

- Watch demo videos of reporting, planning and dashboards

TAGS: Reporting, Consolidation, Budgeting, CPM, ERP, Financial Reporting, Template Library

Global Headquarters

Solver, Inc.

Phone: +1 (310) 691-5300