Related Posts

BLOG HOME

- Headcount Dashboard for SaaS Companies using Dynamics 365 Business Central

- Top 50 Opportunities Report for SaaS Companies using Dynamics 365 BC

- Subscription Sales by Contract Length Report for SaaS Companies using Dynamics 365 Business Central

- Lead Target Model for SaaS Companies using Dynamics 365 Business Central

- Cap Table Template for SaaS Companies using Dynamics 365 Business Central

Automated Narrative for Nonprofit Financial Statements

What is

a

Automated Narrative for Nonprofit Financial Statement

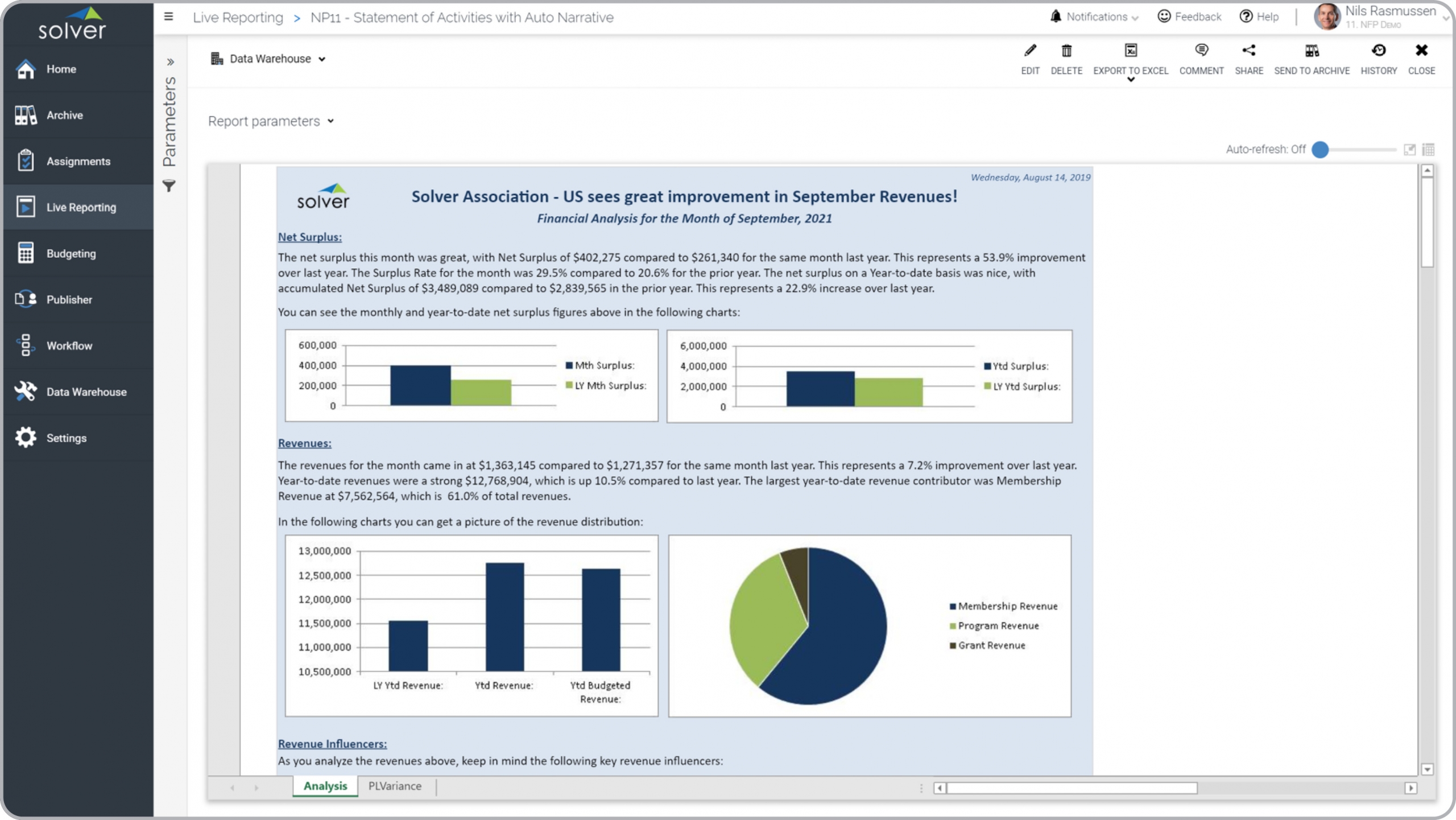

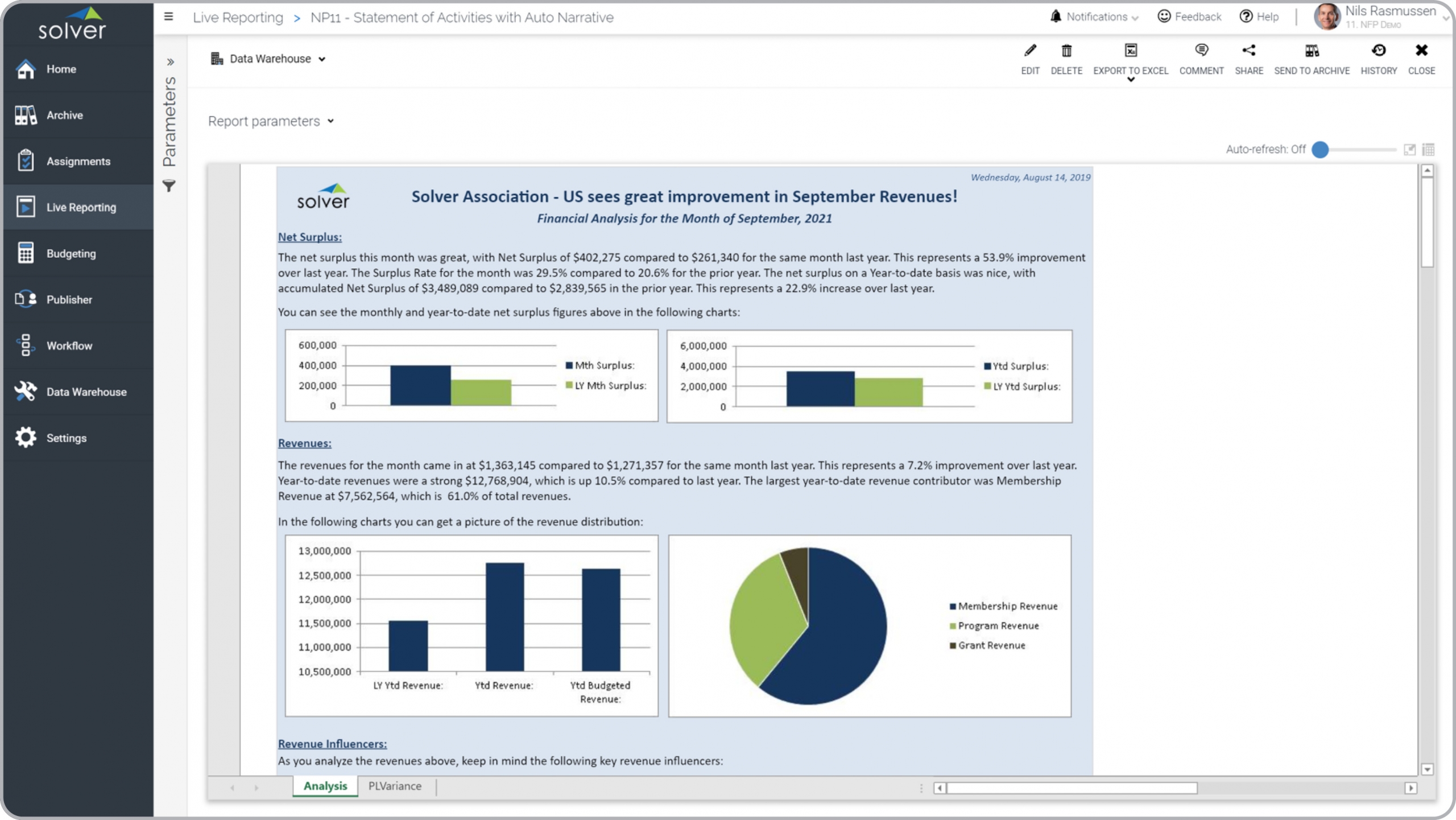

s? Financial statements with automated narratives are considered modern analysis tools and are used by Board members, CFOs as well as other users and accountants to get an always concise, up-to-date and easy-to-read financial status. Some of the key functionality in this type of combined financial and narrative report is that it typically provides two pages (see tabs at bottom of the image). The first page is an automatically generated narrative that pulls the most essential metrics from the second page, which is an ordinary financial report. You find an example of this type of combined financial and narrative below.

Purpose of

Auto-narrative Reports Nonprofits and associations use Auto-narrative Reports to provide highly user-friendly financial updates to managers outside of the accounting department. When used as part of good business practices in a Financial Planning & Analysis (FP&A) department, an organization can improve its financial literacy and manager engagement as well as reduce the chances that few people outside of accounting follow and comments on financial performance.

Auto-narrative Report

Example Here is an example of an Automated Narrative Report for a Nonprofit Financial Statement. [caption id="" align="alignnone" width="2560"]

Example of an Automated Narrative for a Nonprofit Financial Statement[/caption] You can find hundreds of additional examples

here

Who Uses This Type of

Combined financial and narrative

? The typical users of this type of combined financial and narrative are: Executives, department heads, board members.

Other

Combined financial and narrative

s Often Used in Conjunction with

Auto-narrative Reports Progressive Financial Planning & Analysis (FP&A) departments sometimes use several different Auto-narrative Reports, along with balance sheets, statement of activities, statement of cash flows, financial dashboards and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

Example of an Automated Narrative for a Nonprofit Financial Statement[/caption] You can find hundreds of additional examples

here

Who Uses This Type of

Combined financial and narrative

? The typical users of this type of combined financial and narrative are: Executives, department heads, board members.

Other

Combined financial and narrative

s Often Used in Conjunction with

Auto-narrative Reports Progressive Financial Planning & Analysis (FP&A) departments sometimes use several different Auto-narrative Reports, along with balance sheets, statement of activities, statement of cash flows, financial dashboards and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

Example of an Automated Narrative for a Nonprofit Financial Statement[/caption] You can find hundreds of additional examples

here

Who Uses This Type of

Combined financial and narrative

? The typical users of this type of combined financial and narrative are: Executives, department heads, board members.

Other

Combined financial and narrative

s Often Used in Conjunction with

Auto-narrative Reports Progressive Financial Planning & Analysis (FP&A) departments sometimes use several different Auto-narrative Reports, along with balance sheets, statement of activities, statement of cash flows, financial dashboards and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

Example of an Automated Narrative for a Nonprofit Financial Statement[/caption] You can find hundreds of additional examples

here

Who Uses This Type of

Combined financial and narrative

? The typical users of this type of combined financial and narrative are: Executives, department heads, board members.

Other

Combined financial and narrative

s Often Used in Conjunction with

Auto-narrative Reports Progressive Financial Planning & Analysis (FP&A) departments sometimes use several different Auto-narrative Reports, along with balance sheets, statement of activities, statement of cash flows, financial dashboards and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

- Native ERP report writers and query tools

- Spreadsheets (for example Microsoft Excel)

- Corporate Performance Management (CPM) tools (for example Solver)

- Dashboards (for example Microsoft Power BI and Tableau)

- View 100’s of reporting, consolidations, planning, budgeting, forecasting and dashboard examples here

- Read more about Nonprofit solutions here

- See how reports are designed in a modern report writer using a cloud-connected Excel add-in writer

- Discover how the Solver CPM solution delivers financial and operational reporting

- Discover how the Solver CPM solution delivers planning, budgeting and forecasting

- Watch demo videos of reporting, planning and dashboards

TAGS: Reporting, Budgeting, CPM, ERP, Industry, Financial Reporting, Template Library

Global Headquarters

Solver, Inc.

Phone: +1 (310) 691-5300