Related Posts

BLOG HOME

- How the Solver Contributor User Expands Budget Planning Beyond Finance

- Better Reporting Leads to Better Business Decisions

- Advanced Planning Tools Foster Business Success

- xFP&A Software for Financial Consolidation Drives Intelligent Decisions

- Best Practices in Creating Consolidated Financial Statements

Cloud-based Call Report Automation for Banks

This article will focus on Cloud-based Call Report Automation for Banks.

Why does going to the dentist always seem stressful? I have been going to the same dentist for over twenty years. He has seen my children grow up. He has seen me change jobs a couple of times. My wife has even joined his team in a fund raiser or two. You would think that every time I see him, a warm fuzzy feeling would overcome my emotions.

The problem is that each time I see him, my palms get sweaty, my sinuses swell up, and my blood pressure elevates. Yes, he has drilled a few holes, replaced a crown or two, and taken expensive x-rays in the past. But for the most part, our visits have gone smoothly. It just seems that every time I see my dentist, I always get stressed out for no real reason. Let’s face it, filling out the quarterly

Call Reports for the

FDIC can be just as stressful if not more. It has to be done periodically so the FDIC can monitor results. Every once in a while, some corrective behavior needs to take place. But for the most part, the filings are a non-event other than just taking up your precious time.

The purpose of the Call Reports –

Investopedia defines the Call Report as follows: A report that must be filed by all regulated financial institutions in the U.S. on a quarterly basis and contains financial information about the banks. Banks are required to file no later than 30 days after the end of each quarter. The report is officially known as the

Report of Condition and Income for banks and

Thrift Financial Report for Thrifts. The Call Report collects such basic financial information as the bank's balance sheet and income statement. Reports are required to be submitted to the Federal Financial Institutions Examination Council (

FFIEC). The FFIEC is an inter-agency entity and coordinates between the

Federal Reserve, the FDIC and the

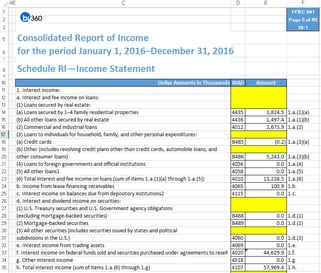

Office of Thrift Supervision. Banks and Thrifts must use the standardized forms provided by the FFIEC to submit their data and each Call Report is audited by an FDIC analyst for errors and audit flags. These reports are available to the public on the FDIC website. A sampling of the Report of Income (RI) schedules include:

Why does going to the dentist always seem stressful? I have been going to the same dentist for over twenty years. He has seen my children grow up. He has seen me change jobs a couple of times. My wife has even joined his team in a fund raiser or two. You would think that every time I see him, a warm fuzzy feeling would overcome my emotions.

The problem is that each time I see him, my palms get sweaty, my sinuses swell up, and my blood pressure elevates. Yes, he has drilled a few holes, replaced a crown or two, and taken expensive x-rays in the past. But for the most part, our visits have gone smoothly. It just seems that every time I see my dentist, I always get stressed out for no real reason. Let’s face it, filling out the quarterly

Call Reports for the

FDIC can be just as stressful if not more. It has to be done periodically so the FDIC can monitor results. Every once in a while, some corrective behavior needs to take place. But for the most part, the filings are a non-event other than just taking up your precious time.

The purpose of the Call Reports –

Investopedia defines the Call Report as follows: A report that must be filed by all regulated financial institutions in the U.S. on a quarterly basis and contains financial information about the banks. Banks are required to file no later than 30 days after the end of each quarter. The report is officially known as the

Report of Condition and Income for banks and

Thrift Financial Report for Thrifts. The Call Report collects such basic financial information as the bank's balance sheet and income statement. Reports are required to be submitted to the Federal Financial Institutions Examination Council (

FFIEC). The FFIEC is an inter-agency entity and coordinates between the

Federal Reserve, the FDIC and the

Office of Thrift Supervision. Banks and Thrifts must use the standardized forms provided by the FFIEC to submit their data and each Call Report is audited by an FDIC analyst for errors and audit flags. These reports are available to the public on the FDIC website. A sampling of the Report of Income (RI) schedules include:

Why does going to the dentist always seem stressful? I have been going to the same dentist for over twenty years. He has seen my children grow up. He has seen me change jobs a couple of times. My wife has even joined his team in a fund raiser or two. You would think that every time I see him, a warm fuzzy feeling would overcome my emotions.

The problem is that each time I see him, my palms get sweaty, my sinuses swell up, and my blood pressure elevates. Yes, he has drilled a few holes, replaced a crown or two, and taken expensive x-rays in the past. But for the most part, our visits have gone smoothly. It just seems that every time I see my dentist, I always get stressed out for no real reason. Let’s face it, filling out the quarterly

Call Reports for the

FDIC can be just as stressful if not more. It has to be done periodically so the FDIC can monitor results. Every once in a while, some corrective behavior needs to take place. But for the most part, the filings are a non-event other than just taking up your precious time.

The purpose of the Call Reports –

Investopedia defines the Call Report as follows: A report that must be filed by all regulated financial institutions in the U.S. on a quarterly basis and contains financial information about the banks. Banks are required to file no later than 30 days after the end of each quarter. The report is officially known as the

Report of Condition and Income for banks and

Thrift Financial Report for Thrifts. The Call Report collects such basic financial information as the bank's balance sheet and income statement. Reports are required to be submitted to the Federal Financial Institutions Examination Council (

FFIEC). The FFIEC is an inter-agency entity and coordinates between the

Federal Reserve, the FDIC and the

Office of Thrift Supervision. Banks and Thrifts must use the standardized forms provided by the FFIEC to submit their data and each Call Report is audited by an FDIC analyst for errors and audit flags. These reports are available to the public on the FDIC website. A sampling of the Report of Income (RI) schedules include:

Why does going to the dentist always seem stressful? I have been going to the same dentist for over twenty years. He has seen my children grow up. He has seen me change jobs a couple of times. My wife has even joined his team in a fund raiser or two. You would think that every time I see him, a warm fuzzy feeling would overcome my emotions.

The problem is that each time I see him, my palms get sweaty, my sinuses swell up, and my blood pressure elevates. Yes, he has drilled a few holes, replaced a crown or two, and taken expensive x-rays in the past. But for the most part, our visits have gone smoothly. It just seems that every time I see my dentist, I always get stressed out for no real reason. Let’s face it, filling out the quarterly

Call Reports for the

FDIC can be just as stressful if not more. It has to be done periodically so the FDIC can monitor results. Every once in a while, some corrective behavior needs to take place. But for the most part, the filings are a non-event other than just taking up your precious time.

The purpose of the Call Reports –

Investopedia defines the Call Report as follows: A report that must be filed by all regulated financial institutions in the U.S. on a quarterly basis and contains financial information about the banks. Banks are required to file no later than 30 days after the end of each quarter. The report is officially known as the

Report of Condition and Income for banks and

Thrift Financial Report for Thrifts. The Call Report collects such basic financial information as the bank's balance sheet and income statement. Reports are required to be submitted to the Federal Financial Institutions Examination Council (

FFIEC). The FFIEC is an inter-agency entity and coordinates between the

Federal Reserve, the FDIC and the

Office of Thrift Supervision. Banks and Thrifts must use the standardized forms provided by the FFIEC to submit their data and each Call Report is audited by an FDIC analyst for errors and audit flags. These reports are available to the public on the FDIC website. A sampling of the Report of Income (RI) schedules include:

- RI—Income statement

- RI-A—Changes in bank equity capital

- RI-B—Charge-offs and recoveries on loans and leases and changes in allowance for loan and lease losses

- RI-E—Explanations

- RC—Balance sheet

- RC-A—Cash and balances due from depository institutions

- RC-B—Securities

- RC-C, Part I—Loans and leases

- RC-E—Deposit liabilities

- Flexibility – Cloud services are there when you need them. Whether it is for daily reporting or once a quarter, it there and ready when you are and gives you the flexibility to scale up or down very quickly.

- Disaster recovery – Losing all of your work due to a hard drive crash is the quickest way to give your accountants a cardiac arrest. Cloud services routinely back up everything so your accountant can sleep well at night.

- Automatic software updates – Do you want your accountants worrying about software updates? Your Cloud provider keeps your reporting tools current for you.

- Capital-expenditure Free – With Cloud, there are no bug upfront expenditures. You simply rent as you go (SaaS).

- Increased collaboration – Many of the RI and RC schedules require input from multiple departments such as credit administration, collections, and accounting. Cloud allows for all of them to collaborate on the same documents without having to e-mail everybody and worrying about version control.

- Work from anywhere – With Cloud, you can even work from home in your pajamas! Al you need is internet access.

- Security – Losing laptops and data breaches cost companies huge sums of money. Cloud providers already spend mass amounts money on the latest and greatest data security tools. Much more than what any one bank can afford. If your accountant loses their laptop, who cares. All their work is still safe and secure on the Cloud.

- Excel-based report writer – I have been implementing Microsoft Excel automation tools for several years now and occasionally I will run into an organization where the IT department is on a mission to eliminate Excel. What is funny is that I will talk to the accountants separately and they always tell me that after IT leaves the room, they will go into a closet and pull out Excel to prepare their reports. Accountants love Excel and that is not going to change anytime soon. So the solution better use an Excel add-in as its report writer or the accountants will not use it.

- Data warehouse – Data for the Call Reports comes from applications that include General Ledger, Loans, Deposits, Collections, Securities, and others. Putting all the data into one location will drastically cut down on the time needed for data gathering and analysis. Using a data warehouse to accomplish goal is a must.

- Ability to store multiple charts of accounts – One of the nice things about the RI and RC schedules is that they label each of the row inputs with quasi account numbers. Using the RI schedule above, you can see the RAID numbers used for each of the line items. In order to automate your schedules, your solution will need the ability to create multiple charts of accounts on the same data. For example, you GL account numbers for interest income will need the alternate RAID account ID’s for effective reporting. Same thing would apply for category codes in your loan trial having the alternate Call Reports codes.

TAGS: Reporting, Consolidation, Budgeting, CPM, ERP, Data warehouse, Dashboards, Industry

Global Headquarters

Solver, Inc.

Phone: +1 (310) 691-5300