This article is part 1 of an 8-part series on evaluating the best CPM tools for your business. Part 1 focuses on evaluating planning capabilities within the best budgeting and forecasting software applications. Planning software is used to streamline budgeting and forecasting processes and belongs to a software category typically referred to as Corporate Performance Management (CPM). Whether caused by economic uncertainty or a more competitive marketplace, this type of cloud software is rapidly increasing in popularity right now. After all, companies that can deliver accurate budgets to plan for their resource allocations, and that continuously update their forecasts to help predict results, get an edge over businesses that don’t have this capability. However, just implementing a CPM software to streamline the planning processes is not the entire solution for delivering an optimized system for budgeting and forecasting. While there are now dozens of software vendors that can deliver CPM software with planning features, you also need to make sure that the solution is RIGHT for your business. This means that the functionality must be right for your unique company and its budgeting and forecasting needs, and it also has to support industry-specific requirements. And of course, the

return on investment (ROI ) needs to be positive. When working through a software selection process to find the planning software for your organization, there are some features to look for that are more important than others.

Here are some of the top features to look for to find the best budgeting and forecasting app While most vendors can probably showcase more than 100 features in their product (something which can make software selection a virtual nightmare), there is a clear 80/20 rule that can be applied when you are ready to zoom in on critical success factors. Here is a list of five major functionality areas:

- Flexible input form and report designer

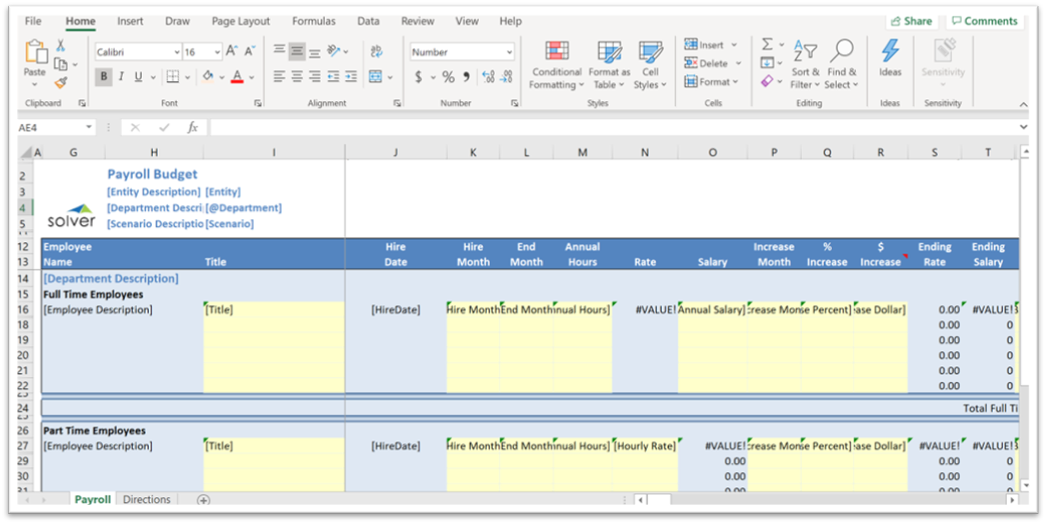

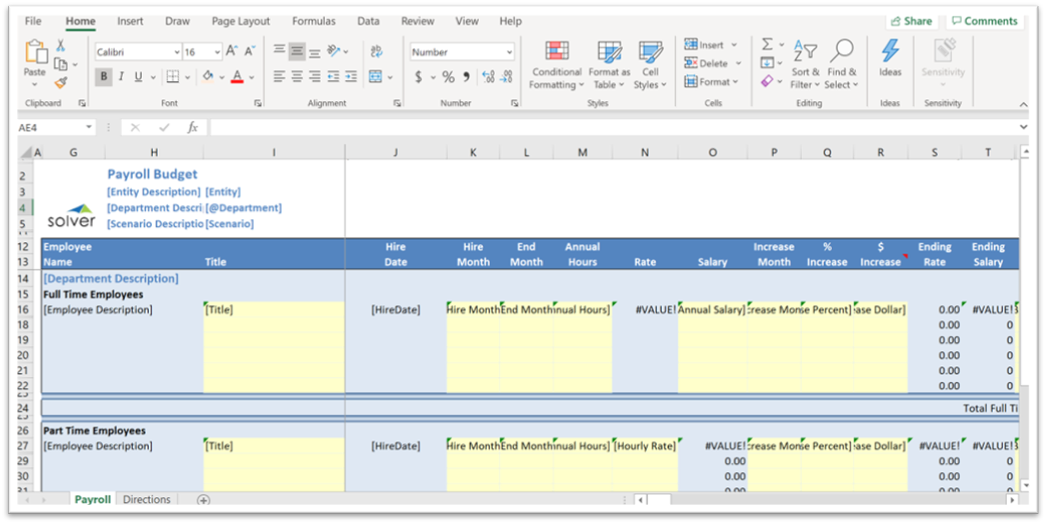

All the best budgeting and forecasting solutions have a “template designer.” In addition to the pre-built input forms and reports that a CPM solution should provide out of the box, the template designer is where a trained user or consultant can build new templates or tailor existing ones to the specific needs of the business. About half of the CPM vendors have built

add-ins to Microsoft Excel where templates are designed. This typically provides the best layout and the richest formula choices, and, of course, most finance departments are very familiar with Excel already which shortens the learning curve. Other vendors have built a proprietary template designer, often with formulas that are similar to Excel.

Note: Be aware of CPM vendors that have two template designers because that means twice as much training for power users. It can become messy in workflows, report packages, and other areas if templates are created with two different technologies. The reason for two tools is almost always that the functionality in the vendor’s proprietary designer was not enough for their customers, so they then added an Excel designer to handle complex customer models with a lot of formatting. Without a strong template designer in your new planning solution, you are at high risk of either significantly having to change your favorite budget input formats to fit the capability of the vendor’s tool or, in many cases, of keeping a portion of your planning models in manual spreadsheets. Having a flexible and user-friendly template designer also allows for the creation of budget reports that can be run throughout the budget process to see real-time budget updates and identify potential areas of concern. This helps you address issues quickly and early in the process – meaning you will have better visibility and more accurate projections.

Here is list of about 500 examples of reports, budgeting, and forecasting forms, as well as dashboards. It is a good idea to ask your vendor candidates if you can see examples from their template libraries. The more examples they provide, the more you can be assured that their solution has a good template designer.

Note: Be aware of CPM vendors that have two template designers because that means twice as much training for power users. It can become messy in workflows, report packages, and other areas if templates are created with two different technologies. The reason for two tools is almost always that the functionality in the vendor’s proprietary designer was not enough for their customers, so they then added an Excel designer to handle complex customer models with a lot of formatting. Without a strong template designer in your new planning solution, you are at high risk of either significantly having to change your favorite budget input formats to fit the capability of the vendor’s tool or, in many cases, of keeping a portion of your planning models in manual spreadsheets. Having a flexible and user-friendly template designer also allows for the creation of budget reports that can be run throughout the budget process to see real-time budget updates and identify potential areas of concern. This helps you address issues quickly and early in the process – meaning you will have better visibility and more accurate projections.

Here is list of about 500 examples of reports, budgeting, and forecasting forms, as well as dashboards. It is a good idea to ask your vendor candidates if you can see examples from their template libraries. The more examples they provide, the more you can be assured that their solution has a good template designer.

- Line item detail and comments

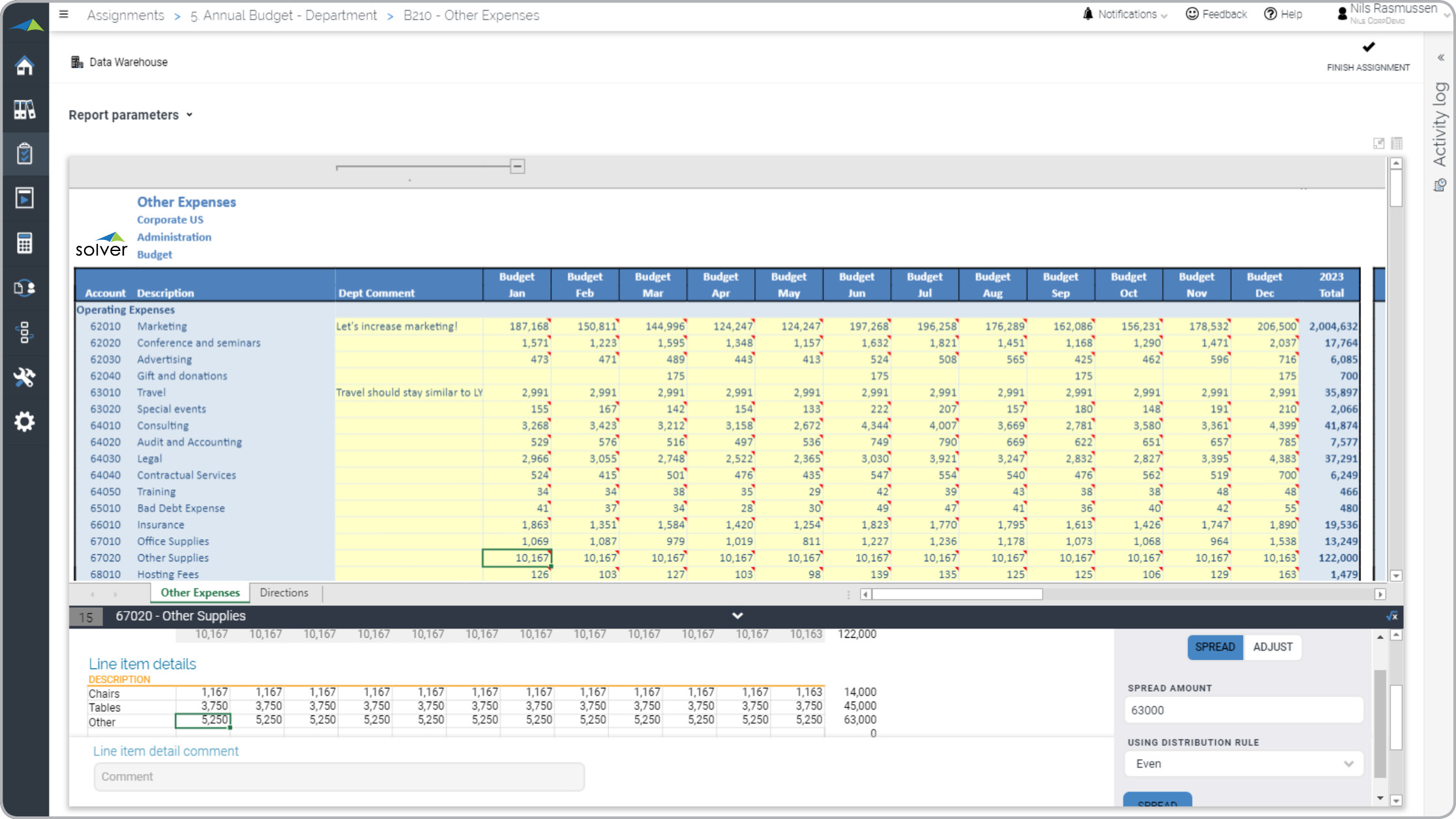

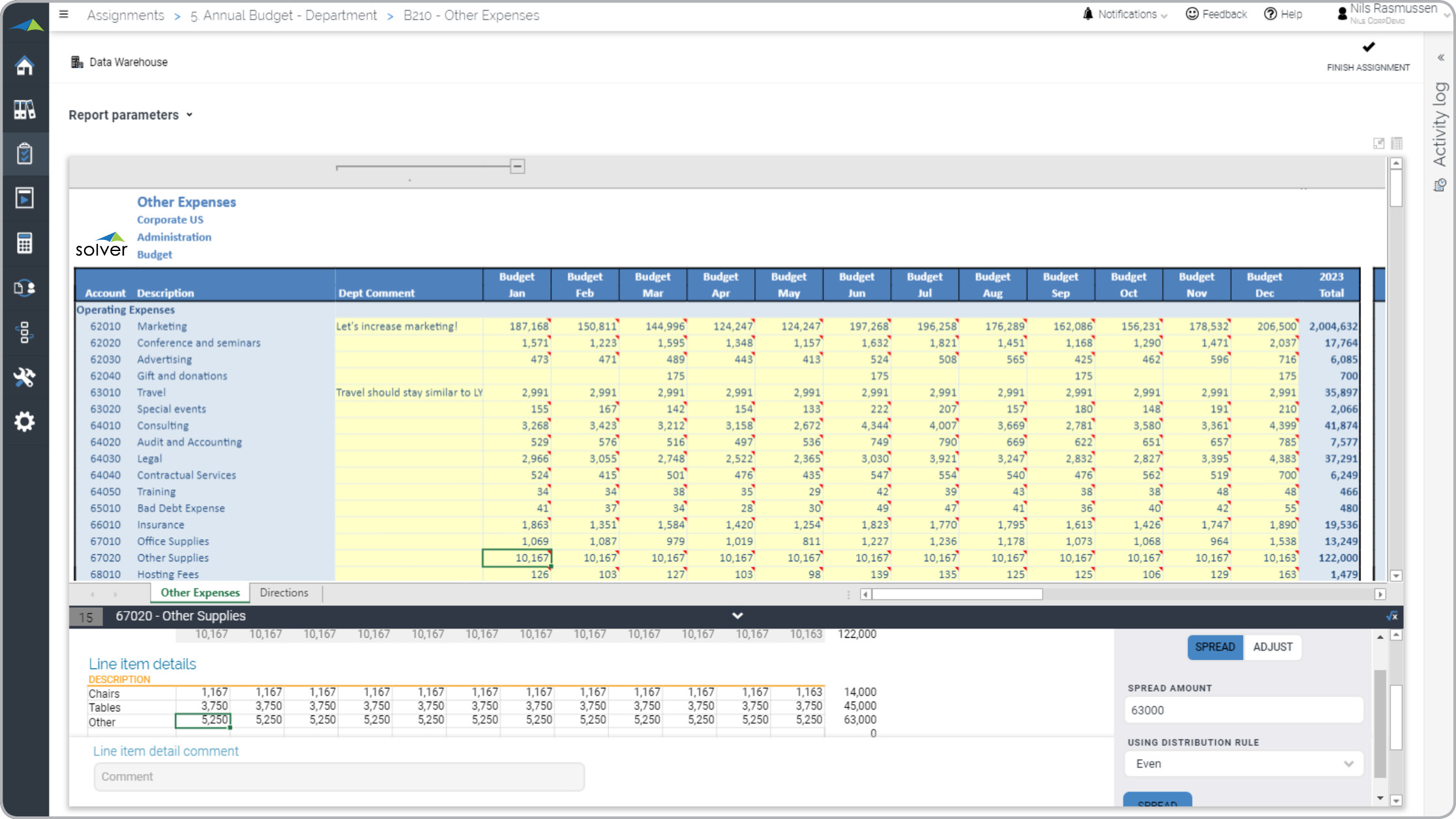

Especially in annual budget processes, these are very important features to ensure proper documentation and justification of sales figures, expenses, or other figures that a user enters in their department. Typical examples of areas where line item detail and comments are frequently used include Travel Expenses and Office Supplies. When end users are actively using line item detail and they enter comments wherever an explanation is needed, it also tends to increase their sense of ownership and accountability in the budget they are submitting.

Input of expenses at the GL account level. Includes line item detail, spreading, etc.

Without line item detail, an end user may have to keep detailed build-ups in spreadsheets. Alternatively, they may simply enter higher level figures with no bottom-up calculation behind their numbers. Both of these approaches may result in more inaccurate budgets, as well as delays in the budget process as budget approvers and reviewers often have to ask department heads and other end users to provide explanations and additional detail to back up their numbers.

- Workflow and checklists

Organizations that decide to buy a planning software typically have 10 or more users and sometimes hundreds of users. Strong workflow functionality can be a huge time saver by managing:

- Deadlines

- Open and closed budgets

- Budget statuses (submitted, approved, rejected, etc.)

- Which input forms should be used by different departments

- And more

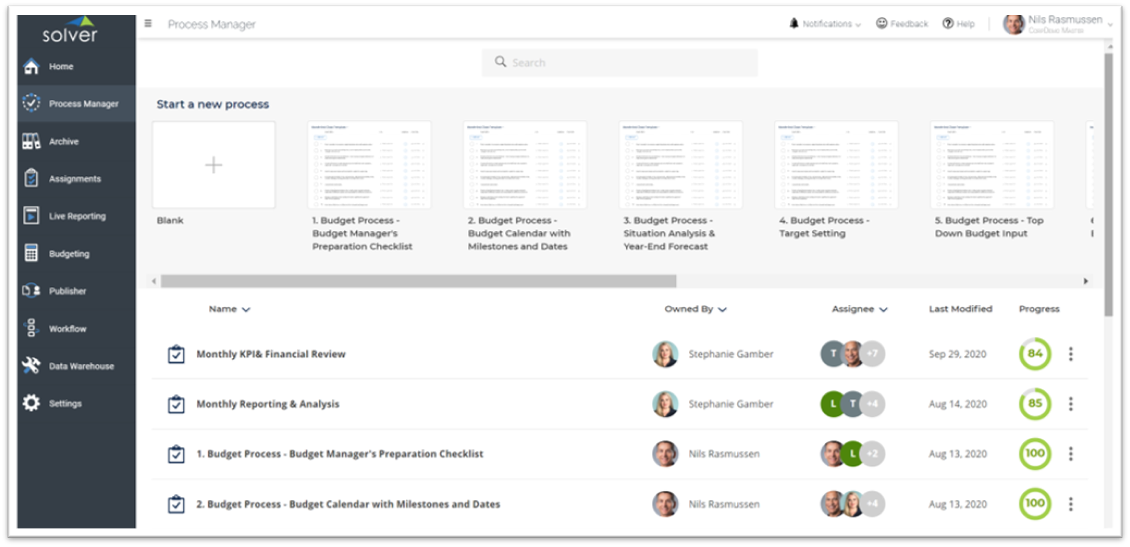

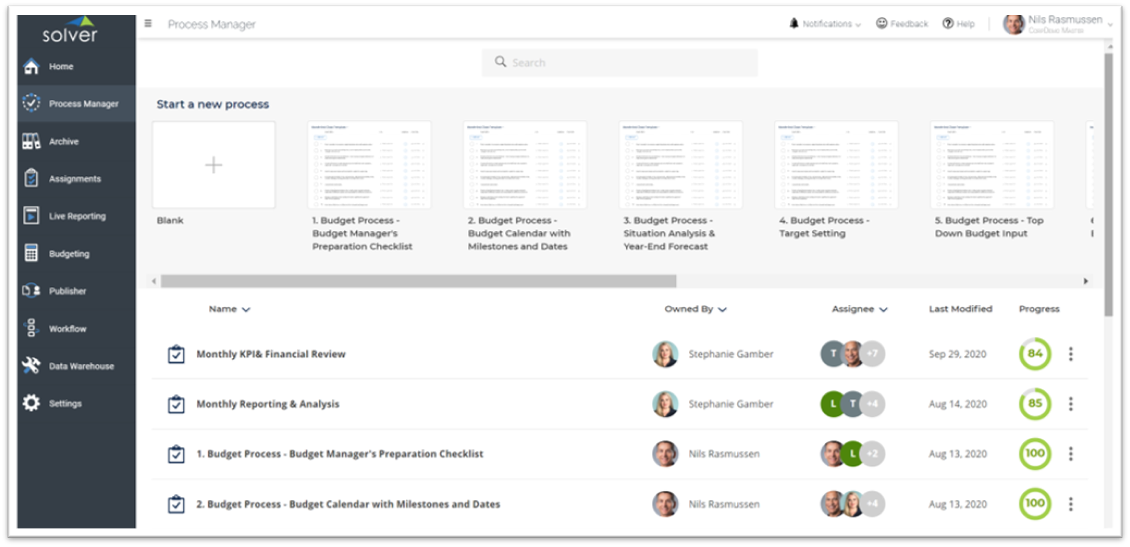

While most modern cloud-based planning solutions offer workflow modules, checklists are rarer. A budget checklist is typically a chronologically organized list of all the items a budget manager has to perform or oversee in a corporate planning process. A checklist could start with strategic goals and steps to forecast the rest of the current year, then go into the actual budget process, and finish with reporting and consolidation of the final budget and executive presentations. Checklists help ensure that everything gets done on time and often include functionality like checkbox, description, responsible person, a link to activity, deadline, and notifications.

Planning and reporting process manager

Without a good workflow module and checklists, chances are good that you are spending a lot more time reminding people of deadlines, asking if their numbers are final and ready for approval, and otherwise managing the process. Processes can get even more frustrating and complex to manage manually in companies that have multiple budget versions to keep track of.

- ERP and payroll integrations

While all good CPM solutions can import actual data from source systems such as ERPs and payroll software, the quality and complexity to configure automated integrations varies a lot. Complexity grows when you have data sources spread between cloud and on-premises. For example, it is not unusual that a company’s ERP system is a legacy on-premises or hosted solution and they have other data sources such as payroll that may be a cloud solution. This results in multiple different direct and/or file-based integrations. When you are evaluating different CPM vendors for your budgeting and forecasting needs, you should request detailed information about each solution’s integration to your systems, including the time and cost it takes to get them configured. A really good, pre-built integration should take

at the most an hour to configure, while “toolboxes” can take days to set up and connect to each data source. Which one your vendor offers will therefore usually become clear when you see their estimates for the integration step in the implementation. Without good, automated integrations to your source systems, your users will end up spending a lot of wasted time on loading and possible “cleaning” of data.

Here is an example of the advantages of a pre-built ERP integration and how it can enable users to get immediate, “day one” benefits from out-of-the-box budget and forecast input forms, reports and dashboards.

- Built for cloud

While on-premises planning solutions were the standard technology for decades, today it is cloud solutions that rule. Planning solutions that are built with native cloud architecture offer many benefits over the classic on-premises solutions. These include back-end functionality such as multi-tenancy to allow for efficient and frequent upgrades, spreading of processing and data loads across hardware resources, and otherwise taking advantage of what large public cloud data centers and platforms have to offer. As an example, in the old on-premises world it was normal to perform an annual upgrade of a software, while in the cloud world, it is the norm to provide completely free and automated monthly updates. This practice also provides users with a continuous stream of new features and bug fixes. Without a purpose-built cloud architecture, a vendor will fall behind their competitors over time. A number of the legacy on-premises vendors did not rebuild their technologies to be optimized for the cloud and, as a result, they will at some point have to rebuild their product or their customers will migrate to other vendors.

How much does budgeting and forecasting software cost? While it is important to do your homework to ensure that the vendor you choose has the key features needed for a successful deployment, the total cost and the savings in time and effort, as well as improved decision making, are just as important. Here are some things to think about when you get prices from your vendor finalists:

- Does the annual subscription from each vendor contain the same user count and modules?

- If you are receiving a discount, how long until it resets to the list price?

- Does the vendor have a written policy for annual price increases?

- Are the implementation estimates from each vendor for exactly the same work?

A good rule of thumb is to ask each vendor for the total subscription cost for the first 5 years. Make sure this includes any potential price increases. Also, if the vendor is owned by a private equity firm, chances are that they will be sold while you are still a customer. It is a smart idea to ensure that you receive a document from the vendor that states their policy for price increases in the future, including if they are sold to another company.

Here is a tool to help you compare vendors and calculate return on investment (ROI).

Why not use Excel or the budgeting and forecasting functionality in my ERP system? Excel is by far the world’s most popular budgeting tool because it is free (if you already own Excel), incredibly flexible, and almost all accounting and finance professionals know how to use it. If you have a simple budget model and few users, Excel may very well be the best planning software for your business – but everyone knows when it is time to replace their homegrown spreadsheets with something better. Warning signals include:

- Painful distribution

- Troubles with collection and consolidation of spreadsheets

- Broken links

- Poor reporting

- Lack of user security

- Versioning issues

All ERP systems have basic budgeting functionality, but that is rarely enough to handle full-fledged budgeting and forecasting processes. And, regardless of an ERP vendor’s promotion of their built-in planning features, almost always companies end up back in Excel with their budget models even after they buy a brand-new cloud ERP solution. When Excel gets too painful, they acquire a CPM solution.

Conclusion In summary, choosing a new CPM solution to automate the planning process, as well as to support better and faster decisions, is increasingly becoming a strategic priority for organizations across all industries. As we discussed earlier, certain features are more important than others and can be key drivers of success, in addition to a well-executed implementation process. Here is a free vendor comparison tool to help you compare vendors across a number of different features. This tool also includes a simple return on investment (ROI) calculator that is part of the total vendor score.

Links to useful software research and evaluation assets

Note: Be aware of CPM vendors that have two template designers because that means twice as much training for power users. It can become messy in workflows, report packages, and other areas if templates are created with two different technologies. The reason for two tools is almost always that the functionality in the vendor’s proprietary designer was not enough for their customers, so they then added an Excel designer to handle complex customer models with a lot of formatting. Without a strong template designer in your new planning solution, you are at high risk of either significantly having to change your favorite budget input formats to fit the capability of the vendor’s tool or, in many cases, of keeping a portion of your planning models in manual spreadsheets. Having a flexible and user-friendly template designer also allows for the creation of budget reports that can be run throughout the budget process to see real-time budget updates and identify potential areas of concern. This helps you address issues quickly and early in the process – meaning you will have better visibility and more accurate projections.

Here is list of about 500 examples of reports, budgeting, and forecasting forms, as well as dashboards. It is a good idea to ask your vendor candidates if you can see examples from their template libraries. The more examples they provide, the more you can be assured that their solution has a good template designer.

Note: Be aware of CPM vendors that have two template designers because that means twice as much training for power users. It can become messy in workflows, report packages, and other areas if templates are created with two different technologies. The reason for two tools is almost always that the functionality in the vendor’s proprietary designer was not enough for their customers, so they then added an Excel designer to handle complex customer models with a lot of formatting. Without a strong template designer in your new planning solution, you are at high risk of either significantly having to change your favorite budget input formats to fit the capability of the vendor’s tool or, in many cases, of keeping a portion of your planning models in manual spreadsheets. Having a flexible and user-friendly template designer also allows for the creation of budget reports that can be run throughout the budget process to see real-time budget updates and identify potential areas of concern. This helps you address issues quickly and early in the process – meaning you will have better visibility and more accurate projections.

Here is list of about 500 examples of reports, budgeting, and forecasting forms, as well as dashboards. It is a good idea to ask your vendor candidates if you can see examples from their template libraries. The more examples they provide, the more you can be assured that their solution has a good template designer.