Related Posts

Best practices for financial scenario planning and analysis 2

With multi-scenario planning, companies can analyze various potential business outcomes and foresee how overall performance would be with each of these models. What would happen to sales? The number of employees? Cash flow?

The key factors of each scenario are identified and modeled to create a complete picture of the budget or forecast. This allows companies to better prepare and predict future performance, helping to account for areas of uncertainty.

Why is multi-scenario financial modeling important?

When companies create an annual budget, they gather the best performance assumptions for the following year. These assumptions are heavily influenced by data and historical trends, the company's strategy, and the industry expertise of each budget participant, along with their view of the current market and economy. The more accurate contributors are with their assumptions, the more accurate the budget will be when compared to actual performance.

It's essential to note that a detailed annual budget represents only one potential outcome among many variables that could unfold in the next year. Although the final version of the budget may be considered the "most likely" outcome based on the organization's experience, it is just one possible scenario.

As the economy, market, and the company's internal operations change, that "most likely" scenario may no longer align with current expectations. In fact, there could be one, two, three, or more high-probability scenarios that executives and financial teams should consider.

Strategy and Scenarios: Aligning and Fine-Tuning

Companies with better outcomes have budgets and forecasts that closely align with the company's strategy. By planning different financial scenarios, companies can proactively prepare for these potential outcomes, ensuring alignment with strategic objectives and providing the ability to adjust quickly to changes when needed.

Companies wishing to implement multi-scenario planning should focus on several key areas:

- Identifying and capturing the company's strategy

- Defining the most probable scenarios

- Internal factors

- External factors

- Using driver-based models to define scenarios

- Measuring performance and refining models

Identifying and Capturing Your Company's Strategy

A well-defined financial and strategic plan serves as a compass to guide the company's activities. However, a critical component for an effective strategy is to ensure that it is not only known and understood by a few at the executive level but is well-socialized throughout the organization and is being used to manage and measure performance.

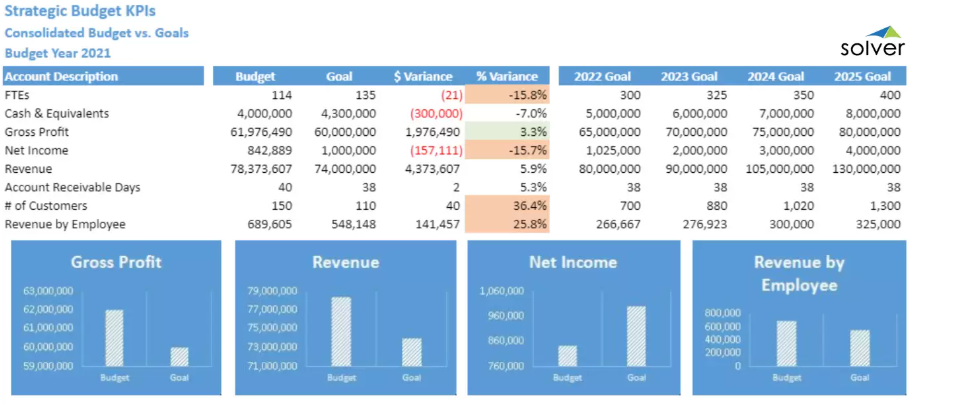

A solid strategic framework allows the company to establish specific strategic goals that can be monitored and measured through key performance indicators (KPIs). These KPIs provide an easy way to define success and measure and share results and objectives within the organization.

For example, if part of the company's strategy focuses on increasing customer satisfaction, some potential KPIs and objectives could be:

- Reduce the average product shipping time from 8 to 2 hours by 6/30/2022

- Increase customer referrals by 15% by 12/31/2021

Importance of Automated Demand Planning

Each of these KPIs effectively defines and measures success by quantifying a goal and setting a deadline for achievement. If we identify, record, and track these indicators as the first step in our planning process, we can ensure that our budget and forecasts align with these goals and, if not, adjust course when necessary.

The following image shows an example KPI report comparing goals with budgeted figures. If there are discrepancies between them, management must determine whether the budget or the strategy needs updating for alignment.

How to Define Likely Financial Scenarios

Although the number of possible business outcomes in a given period is essentially infinite, only a small number of them would be considered "high probability." These highly probable scenarios should be the focus of multiple-scenario planning. The goal is not to model all possible scenarios but to focus on the most significant ones that are more likely to occur.

Building the Internal Scenario Financial Factors

Most internal factors for scenario creation are directly related to the overall company strategy. At this point, the question of "how these strategic objectives will be achieved" transforms into possible scenarios. This is especially important when there is uncertainty or external factors that could affect the direction the company takes to achieve its goals.

In the example above, part of the sample company's strategy focuses on increasing customer satisfaction. To achieve this goal, numerous initiatives could be undertaken, such as:

- Increasing staff to improve shipping time and customer service

- Consolidating operations into a centralized warehouse

- Opening regional distribution centers

Defining each of these in detail allows executives to closely analyze return on investment (ROI) and determine the most effective course of action.

Defining External Financial Scenario Planning Factors

Regardless of how well a company prepares, there are external factors that can disrupt those plans or lead to a change in direction. These vary by company and industry, but some general ones could include:

- Economic recession

- Changes in the market

- Legislative changes

- Competitor change or consolidation

The potential scenarios and combinations of scenarios that can be created are limitless, but the focus should always be on what is likely to happen and what aligns with the company's objectives.

Using Driver-Based Models to Define Scenarios

Recreating an annual budgeting process that is time-consuming to create additional high-probability financial forecasting models is not a viable option. Creating each model should be something that can be done very quickly and easily updated. The most effective way to do this is with a driver-based forecasting model that leverages a top-down approach to generate a baseline from data and historical trends. This initial baseline becomes a starting point that can then be adjusted to a more detailed level for key areas such as revenue forecasting, workforce planning, operating expenses, and cash flow.

Using easily adjustable factors and assumptions allows modeling unlimited outcomes and analyzing hypothetical scenarios in-depth.

Measuring Performance and Refining Models

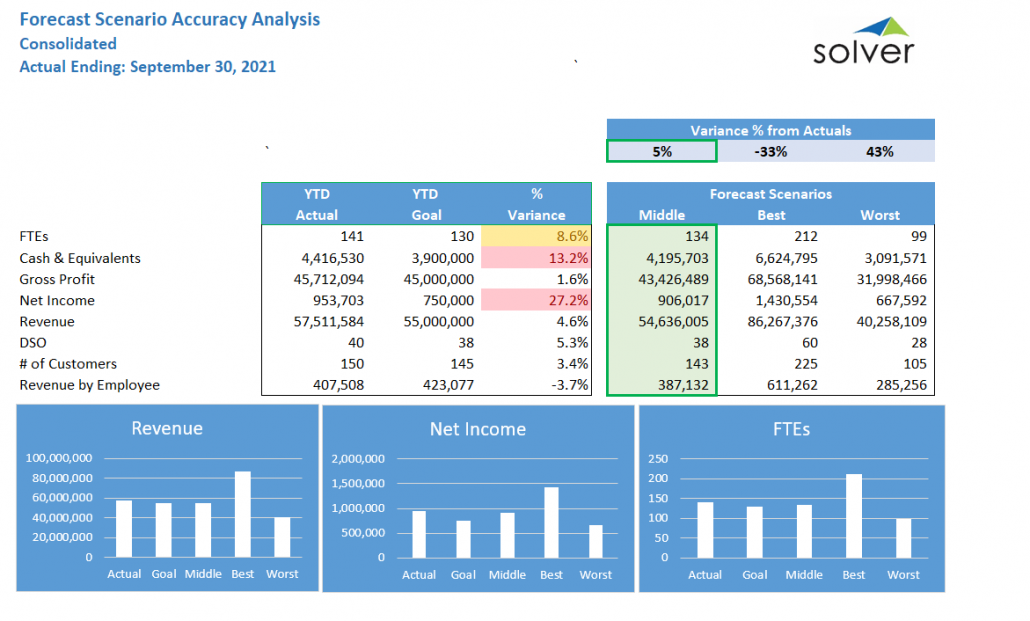

After developing a financial scenario model from the highest probability scenarios, it is crucial not to leave them on the shelf to gather dust but to continuously analyze them for accuracy and ensure that the company is achieving its goals. Simple reports can be used to determine which version of the forecast is proving more accurate, and this forecast version can be incorporated into existing reports and information packages to provide updated projections on time.

The analysis will also identify areas of your model that require adjustments. This may point to an error in assumptions, methodology, or a change in market conditions. By isolating and identifying these deviations, not only is a more accurate financial model created, but a better forecasting process is continuously developed.

How to Start Your Financial Scenario Analysis with Solver

The cloud-based Corporate Performance Management (CPM) solution from Solver provides the necessary tools to streamline and automate the multiple-scenario planning process. For more information, contact Solver or request a demo to see the solution in action.

Links to Useful Software Research and Evaluation Resources

- Vendor comparison tool and ROI calculator

- Solver's Tour Central

- Over 500 budget and report examples

- Analyst reports and ratings: G2 and Dresner

- Software selection blog

Global Headquarters

Solver, Inc.

Phone: +1 (310) 691-5300